Introduction

Welcome to the Stock Market Chronicles! In this series, we delve into the fascinating world of stocks, exploring their history, performance, and the various factors that shape their movements. Today, we embark on a journey into the realm of Adobe stock splits, uncovering the story behind one of the tech industry's most renowned companies and its journey through stock market evolution.

Also Read This: How to Request a Recommendation on LinkedIn for Professionals

The History of Adobe Stock Splits

Stock splits have been pivotal moments in Adobe's journey, marking significant milestones in its growth and market presence. Let's take a closer look at the timeline of Adobe's stock splits:

1. Initial Public Offering (IPO)

Adobe went public on August 20, 1986, with an initial offering of 2.5 million shares priced at $17 each. This marked the beginning of its journey as a publicly traded company.

2. First Stock Split: June 1987

Less than a year after its IPO, Adobe executed its first stock split, a 2-for-1 split. This meant that for every share held, investors received an additional share, effectively doubling the number of outstanding shares. The split aimed to make Adobe's stock more accessible to a broader range of investors.

3. Subsequent Splits

Over the years, Adobe continued to grow and innovate, leading to several more stock splits:

- March 1990: Adobe implemented another 2-for-1 stock split, further increasing its liquidity and market accessibility.

- May 1992: The company underwent yet another 2-for-1 stock split, reflecting its sustained growth and investor confidence.

4. Recent Developments

In recent years, Adobe has solidified its position as a leader in digital media and marketing solutions, driving strong financial performance and shareholder value. While there have been no additional stock splits since 1992, Adobe's stock has continued to thrive, reflecting the company's ongoing success and strategic vision.

Throughout its history, Adobe's stock splits have played a crucial role in democratizing ownership and fostering investor participation, contributing to its status as a cornerstone of the technology sector.

Also Read This: Maximizing Your Earnings with Adobe Stock and Key Factors Influencing Your Income

Implications of Stock Splits on Investors

Stock splits can have several implications for investors, influencing various aspects of their investment experience. Let's explore the key implications:

1. Increased Liquidity and Accessibility

Stock splits increase the number of shares outstanding, making them more affordable for investors. This increased liquidity can attract a broader range of investors, including retail investors who may have previously found the stock price prohibitive.

2. Psychological Impact

Stock splits can have a psychological impact on investors, often leading to a perception of increased affordability and attractiveness. Even though the intrinsic value of the investment remains unchanged, the lower share price post-split may attract new investors who perceive the stock as more accessible.

3. Potential Price Volatility

Following a stock split, there may be increased price volatility in the short term as investors react to the change. This volatility can create trading opportunities for short-term traders but may also lead to increased uncertainty for long-term investors.

4. No Change in Market Capitalization

It's important to note that stock splits do not impact the overall market capitalization of a company. While the number of shares outstanding increases, the value of each share decreases proportionally, resulting in no net change in the company's total market value.

5. Dividend Adjustments

In some cases, stock splits may necessitate adjustments to dividend payments. While the total dividend payout remains unchanged, the per-share dividend amount may be adjusted to reflect the new share count post-split.

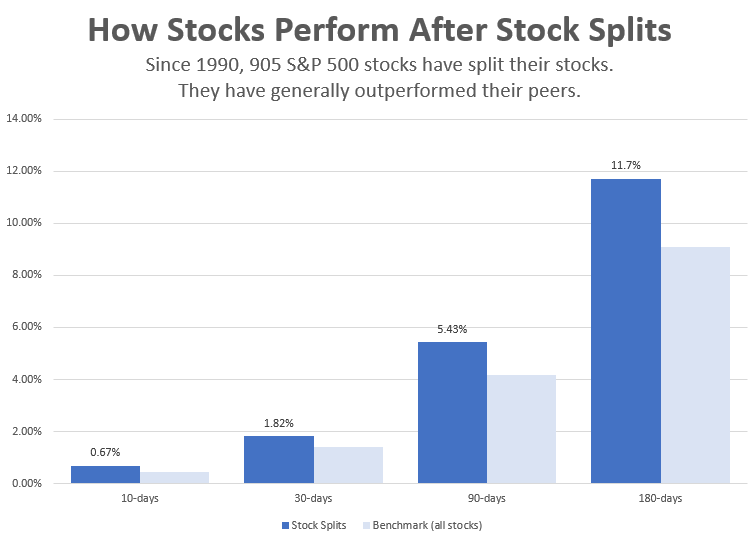

Overall, stock splits can have both short-term and long-term implications for investors, influencing market dynamics, investor sentiment, and trading patterns. Understanding these implications can help investors make informed decisions and navigate the complexities of the stock market with confidence.

Also Read This: Deleting My 123RF Account: Step-by-Step

Factors Influencing Stock Split Decisions

Stock split decisions are influenced by a variety of factors, reflecting both internal considerations within the company and external market dynamics. Let's explore some of the key factors:

1. Share Price

The primary factor influencing stock split decisions is the company's current share price. If the share price has risen significantly and is perceived as too high, management may consider a stock split to reduce the price per share, making it more affordable for investors.

2. Market Perception

Market perception and investor sentiment play a crucial role in stock split decisions. Companies may opt for a stock split to enhance their perceived accessibility and attractiveness to investors, potentially attracting a broader investor base and increasing liquidity.

3. Trading Volume

High trading volume can be both a cause and a consequence of stock splits. Companies experiencing increased trading volume may consider a split to accommodate the growing demand for their stock, while a stock split itself can often lead to heightened trading activity as investors react to the change.

4. Strategic Objectives

Strategic objectives and long-term planning also influence stock split decisions. Companies may use stock splits as part of their broader strategy to manage shareholder value, enhance market liquidity, or position themselves for future growth opportunities.

5. Peer Benchmarking

Companies may also consider the actions of their peers and industry standards when evaluating stock split decisions. If competitors or industry leaders have recently implemented stock splits, it may prompt similar actions to maintain parity and competitiveness within the market.

6. Regulatory Considerations

Regulatory considerations, including exchange listing requirements and shareholder approval processes, can also impact stock split decisions. Companies must ensure compliance with applicable regulations and consider the administrative and procedural aspects of executing a stock split.

Ultimately, stock split decisions are multifaceted and involve a careful assessment of various internal and external factors. By weighing these factors thoughtfully, companies can make informed decisions that align with their strategic objectives and enhance shareholder value.

Also Read This: Explore and Enjoy Dailymotion Playlists

FAQ

Explore answers to commonly asked questions about Adobe stock splits:

1. What is a stock split?

- A stock split is a corporate action in which a company divides its existing shares into multiple shares. This increases the number of outstanding shares while reducing the price per share.

2. How many times has Adobe undergone stock splits?

- Adobe has undergone stock splits multiple times. The notable ones include a 2-for-1 split in June 1987, another 2-for-1 split in March 1990, and an additional 2-for-1 split in May 1992.

3. Why do companies opt for stock splits?

- Companies may opt for stock splits to make their shares more affordable and accessible to a broader range of investors. It can also enhance market liquidity and influence investor perception.

4. What are the implications of a stock split on investors?

- Stock splits can lead to increased liquidity, a psychological impact on affordability, potential price volatility in the short term, and adjustments to dividend payments. However, they do not change the overall market capitalization of the company.

5. How do stock splits impact trading patterns?

- Following a stock split, there may be increased trading activity as investors react to the change. Short-term traders may find new opportunities, while long-term investors may experience increased uncertainty.

6. Are there regulatory considerations for stock splits?

- Yes, companies must consider regulatory requirements, including exchange listing rules and shareholder approval processes, when deciding on stock splits.

7. How do stock split decisions align with a company's strategic objectives?

- Stock split decisions are influenced by various factors, including share price, market perception, trading volume, strategic goals, peer benchmarking, and regulatory considerations. Companies aim to align stock splits with broader strategies for managing shareholder value and market competitiveness.

8. How has Adobe's stock split history contributed to its market presence?

- Adobe's stock split history has increased accessibility and liquidity for investors, contributing to the company's market presence and shareholder value. The splits have played a role in shaping investor perception and dynamics within the technology and finance landscape.

Conclusion

As we conclude our exploration of Adobe's stock split history, it's evident that these corporate actions have played a significant role in shaping the company's trajectory and investor perception. From its initial public offering to subsequent splits, Adobe's journey reflects the dynamic nature of the stock market and the strategic decisions made by company management.

Stock splits have not only increased accessibility and liquidity for investors but have also contributed to the company's overall market presence and shareholder value. By understanding the implications of stock splits and the factors influencing these decisions, investors can better navigate the complexities of the stock market and make informed investment choices.

As Adobe continues to innovate and evolve, its stock split history serves as a testament to its resilience and adaptability in the ever-changing landscape of technology and finance. Whether you're a seasoned investor or just beginning your journey, the lessons learned from Adobe's stock splits offer valuable insights into the dynamics of the market and the strategies employed by companies to drive growth and create value for shareholders.