Introduction

Welcome to our investor insights series, where we delve into the world of stock analysis to provide you with valuable insights. In this edition, we'll be focusing on Getty Images, a renowned name in the visual content industry. Getty Images has long been a leader in providing high-quality visual content to individuals and businesses worldwide. In this article, we'll explore the factors influencing Getty Images share price, recent performance trends, comparative analysis with competitors, and more. Whether you're a seasoned investor or someone new to the world of stocks, join us as we analyze Getty Images share price and uncover potential investment opportunities.

Also Read This: Exploring Trending Photos on EyeEm: Your Guide

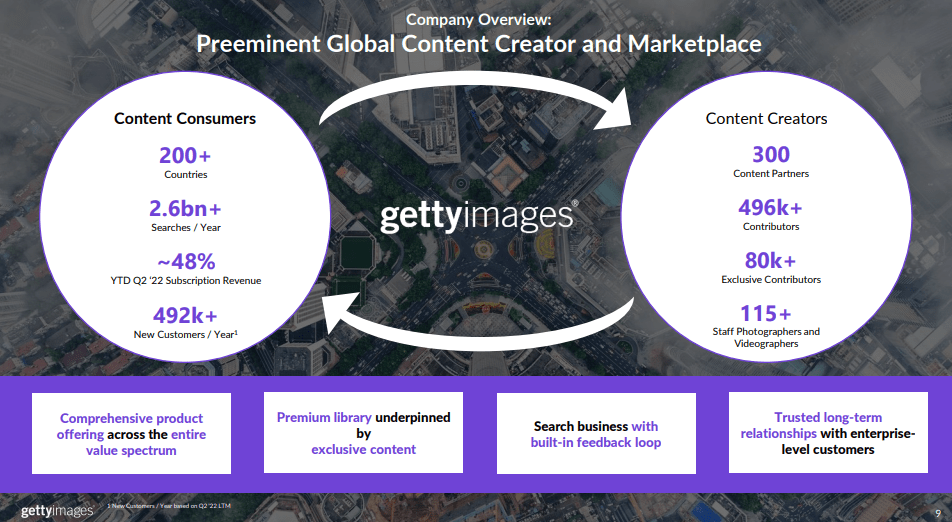

Getty Images: Company Overview

Getty Images, founded in 1995 by Mark Getty and Jonathan Klein, has evolved into one of the world's largest and most prestigious visual content providers. Specializing in stock imagery, editorial photography, video, and music, Getty Images caters to a diverse clientele ranging from individual creatives to multinational corporations.

Here are some key highlights and details about Getty Images:

- Global Presence: Getty Images operates in over 100 countries, with a vast network of contributors and partners worldwide.

- Extensive Content Library: With millions of high-quality images, videos, and music tracks in its collection, Getty Images offers a comprehensive repository of visual assets across various themes and genres.

- Editorial Excellence: Renowned for its editorial photography division, Getty Images provides real-time coverage of news, sports, entertainment, and cultural events, serving media outlets, publishers, and editorial clients.

- Creative Solutions: In addition to stock content, Getty Images offers custom content creation services, licensing solutions, and innovative tools such as Getty Images Connect and Getty Images Embed, enabling seamless integration of visual assets into digital platforms.

- Strategic Partnerships: Getty Images has forged strategic partnerships with leading brands, organizations, and media companies to expand its reach and enhance its offerings.

- Technology Innovation: Leveraging advanced technology and AI-driven solutions, Getty Images continually enhances its search and discovery capabilities, making it easier for users to find the perfect visual content.

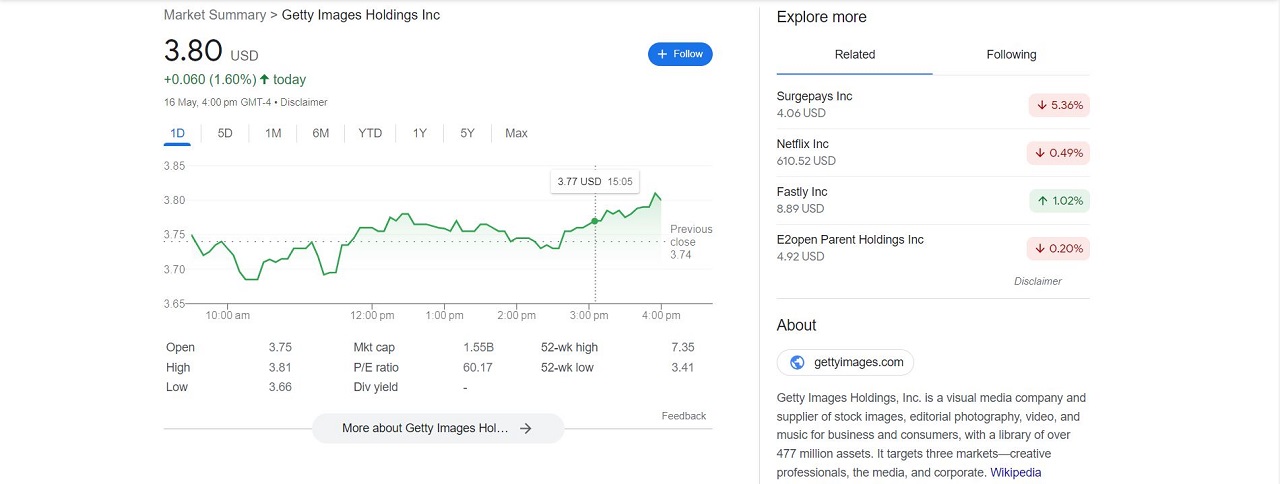

As a publicly traded company, Getty Images is listed on the stock exchange under the ticker symbol GTYI. Its performance and market dynamics play a significant role in shaping investor sentiment and influencing its share price.

Next, we'll delve deeper into the factors that impact Getty Images share price and analyze its financial performance and market position.

Also Read This: Behance space usage explanation

Factors Influencing Getty Images Share Price

Understanding the various factors that influence Getty Images share price is essential for investors looking to make informed decisions. Here are some key factors that can impact the company's stock performance:

- Financial Performance: Getty Images financial health, including revenue growth, profitability, and cash flow, is a critical determinant of its share price. Positive earnings reports and strong financial results often lead to upward movements in the stock price.

- Market Demand for Visual Content: As a provider of visual content services, Getty Images share price can be influenced by the overall demand for images, videos, and other creative assets. Trends in advertising, media consumption, and digital content creation can impact the company's revenue potential.

- Competitive Landscape: The competitive environment within the visual content industry can affect Getty Images market share and pricing power. Competition from other stock photo agencies, as well as disruptive technologies and new market entrants, may impact investor sentiment.

- Technology and Innovation: Getty Images ability to innovate and adopt emerging technologies, such as artificial intelligence and machine learning, can influence its competitiveness and long-term growth prospects. Investments in technology infrastructure and content discovery platforms may drive investor confidence.

- Regulatory Environment: Regulatory changes, copyright laws, and licensing agreements can impact Getty Images operations and revenue streams. Adverse regulatory developments or legal disputes may lead to volatility in the company's share price.

- Macroeconomic Factors: Economic indicators, consumer spending trends, and global market conditions can affect investor sentiment and overall market performance. Factors such as GDP growth, inflation rates, and geopolitical tensions may indirectly impact Getty Images share price.

By monitoring these key factors and conducting thorough analysis, investors can gain insights into Getty Images performance outlook and make well-informed investment decisions.

Next, we'll explore the recent performance trends of Getty Images and analyze its comparative position within the visual content industry.

Also Read This: How to Create a Stunning Project on Behance

Recent Performance and Trends

Examining Getty Images recent performance and identifying underlying trends is crucial for investors seeking to gauge the company's trajectory. Here's an overview of the recent performance metrics and notable trends:

- Revenue Growth: Analyzing Getty Images revenue growth over recent quarters or fiscal years provides insights into the company's top-line performance. Investors typically look for consistent revenue growth as a sign of business vitality and market demand for its services.

- Profitability Metrics: Assessing profitability metrics such as gross margin, operating margin, and net income can help investors understand Getty Images efficiency in generating profits from its operations. Improving profitability ratios often indicate effective cost management and operational optimization.

- Subscriber and Customer Metrics: Monitoring subscriber counts, customer retention rates, and average revenue per user (ARPU) offers visibility into Getty Images customer acquisition and retention efforts. Growing subscriber bases and increasing ARPU may signal a strong value proposition and customer satisfaction.

- Content Licensing Trends: Tracking trends in content licensing, including the volume of image and video downloads, average licensing fees, and licensing revenue per asset, sheds light on the demand for Getty Images visual content across various market segments and geographies.

- Strategic Initiatives: Assessing Getty Images strategic initiatives, such as partnerships, acquisitions, and product launches, provides insights into the company's efforts to expand its market reach, diversify revenue streams, and capitalize on emerging opportunities in the visual content industry.

- Market Positioning: Evaluating Getty Images market share, brand perception, and competitive positioning relative to its peers helps investors understand the company's standing within the visual content industry and its ability to capture market opportunities.

By analyzing these performance metrics and trends, investors can gain a comprehensive understanding of Getty Images recent financial and operational performance, enabling them to make informed investment decisions.

Next, we'll delve into a comparative analysis of Getty Images with its competitors to assess its competitive strengths and weaknesses.

Also Read This: How to Download Getty Images for Free

Comparative Analysis with Competitors

Conducting a comparative analysis of Getty Images with its competitors is instrumental in evaluating its competitive strengths, weaknesses, and market positioning. Here's a breakdown of key aspects to consider in the comparative analysis:

| Aspect | Getty Images | Competitor A | Competitor B |

|---|---|---|---|

| Market Presence | Global presence in over 100 countries | Primarily focused on specific regions or markets | Strong presence in niche segments or industries |

| Content Library | Millions of high-quality images, videos, and music tracks | Varied content library catering to specific niches or themes | Specialized content offerings with unique value propositions |

| Brand Recognition | Well-established brand with global recognition | Varies depending on regional or industry-specific factors | Recognized brand within its target market or industry |

| Technology and Innovation | Leverages advanced technology for content discovery and delivery | Varies based on investment in technology and innovation | Focuses on specific technological innovations or platforms |

| Revenue Model | Diverse revenue streams including content licensing, subscriptions, and custom content services | May rely on specific revenue sources or business models | Varied revenue model tailored to target market segments |

By comparing Getty Images with its competitors across these key dimensions, investors can identify competitive advantages, areas for improvement, and market opportunities. Understanding how Getty Images stacks up against its peers is essential for assessing its long-term growth potential and investment attractiveness.

Next, we'll explore the risks and challenges facing Getty Images and their potential impact on its share price and business performance.

Also Read This: Understanding Adobe Stock Credits and How to Purchase Them

Risks and Challenges

Despite its strong market position and growth prospects, Getty Images faces several risks and challenges that could impact its share price and business performance. It's essential for investors to be aware of these potential pitfalls:

- Market Competition: Intense competition from rival visual content providers, including stock photo agencies, digital media platforms, and freelance creators, may erode Getty Images market share and pricing power, leading to reduced revenue and profitability.

- Technology Disruption: Rapid advancements in technology, such as AI-generated imagery, blockchain-based licensing platforms, and user-generated content communities, pose a threat to Getty Images traditional business model and may require substantial investments in innovation and adaptation.

- Regulatory Risks: Changes in copyright laws, licensing regulations, and data privacy requirements could impact Getty Images operations, content licensing practices, and revenue streams. Legal disputes or compliance issues may result in financial penalties or reputational damage.

- Market Demand Shifts: Shifting consumer preferences, changes in advertising trends, and economic downturns may lead to fluctuations in demand for visual content services, affecting Getty Images revenue growth and financial stability.

- Content Quality and Authenticity: Maintaining the quality, relevance, and authenticity of its content library is crucial for Getty Images brand reputation and customer satisfaction. Instances of copyright infringement, image manipulation, or low-quality content could tarnish the company's image and credibility.

- Global Events and Uncertainties: Geopolitical tensions, natural disasters, and global health crises, such as the COVID-19 pandemic, can disrupt business operations, supply chains, and market dynamics, impacting Getty Images revenue streams and financial performance.

By proactively identifying and addressing these risks and challenges, Getty Images can mitigate potential threats to its business continuity and long-term growth. Investors should closely monitor how the company navigates these challenges and adapts its strategies to maintain its competitive edge in the visual content industry.

Next, we'll explore potential investment opportunities associated with Getty Images and its share price.

Also Read This: Behance download guide

Investment Opportunities

Despite the risks and challenges, Getty Images presents several compelling investment opportunities for investors seeking exposure to the visual content industry. Here are some potential avenues for investment:

- Market Expansion: Getty Images global presence and extensive content library position it to capitalize on the growing demand for visual content across various industries and geographies. Continued expansion into emerging markets and strategic partnerships can unlock new revenue streams and fuel long-term growth.

- Technology Innovation: Investing in technology and innovation is crucial for Getty Images to stay ahead of competitors and meet evolving customer needs. Opportunities exist in AI-driven content discovery platforms, immersive media technologies, and innovative licensing solutions that enhance user experience and drive revenue growth.

- Diversification of Revenue Streams: Getty Images can explore opportunities to diversify its revenue streams beyond traditional content licensing and subscriptions. Initiatives such as e-commerce integration, branded content partnerships, and content monetization platforms offer avenues for generating additional revenue and enhancing shareholder value.

- Content Monetization: Leveraging its vast content library and expertise in content curation, Getty Images can explore new monetization models such as non-fungible tokens (NFTs), digital asset marketplaces, and content syndication platforms. These initiatives can unlock value from existing assets and create new revenue opportunities.

- Strategic Acquisitions: Strategic acquisitions and partnerships can accelerate Getty Images growth strategy and expand its market reach. Targeting complementary businesses, technology startups, or niche content providers can enhance its product offerings, customer base, and competitive position in the visual content ecosystem.

- Sustainable Practices: Embracing sustainability initiatives and ethical content practices can resonate with environmentally conscious consumers and businesses. Investing in eco-friendly content production, carbon offset programs, and diversity and inclusion initiatives can enhance Getty Images brand reputation and attract socially responsible investors.

By capitalizing on these investment opportunities and executing a strategic growth plan, Getty Images can strengthen its market leadership, drive shareholder value, and navigate the evolving landscape of the visual content industry.

Next, we'll address frequently asked questions (FAQ) about Getty Images and its share price.

Also Read This: Creating a LinkedIn Hyperlink for Your Resume

FAQ

Here are some frequently asked questions (FAQ) about Getty Images and its share price:

- What is Getty Images?

Getty Images is a leading provider of visual content, including stock imagery, editorial photography, video, and music, serving individuals and businesses worldwide. - Is Getty Images publicly traded?

Yes, Getty Images is a publicly traded company listed on the stock exchange under the ticker symbol GTYI. - How can I invest in Getty Images?

Investors can purchase shares of Getty Images through a brokerage firm or online trading platform that offers access to the stock market. - What factors influence Getty Images share price?

Getty Images share price can be influenced by various factors, including its financial performance, market demand for visual content, competitive landscape, technology innovation, regulatory environment, and macroeconomic conditions. - What is Getty Images dividend policy?

Getty Images dividend policy, if any, depends on its financial performance, capital allocation priorities, and strategic objectives. Investors should refer to the company's financial reports and investor communications for updates on dividend distributions. - Where can I find more information about Getty Images?

Investors and stakeholders can access Getty Images investor relations website, corporate filings, press releases, and financial reports for comprehensive information about the company, its operations, and financial performance.

For specific inquiries or investment-related advice, it's advisable to consult with a financial advisor or investment professional.

Finally, let's conclude our analysis of Getty Images share price and key insights.

Conclusion

In conclusion, analyzing Getty Images share price and investment potential provides valuable insights into the company's performance, market dynamics, and growth prospects. Despite facing risks and challenges such as market competition, technological disruption, and regulatory uncertainties, Getty Images remains well-positioned to capitalize on opportunities in the visual content industry.

Through its global presence, extensive content library, technology innovation, and strategic initiatives, Getty Images continues to drive revenue growth, expand market reach, and deliver value to shareholders. Investors keen on participating in the visual content market can consider Getty Images as a viable investment opportunity.

By monitoring key factors influencing Getty Images share price, conducting thorough analysis, and staying informed about industry trends and developments, investors can make informed decisions to capitalize on potential opportunities and navigate risks effectively.

As with any investment, it's essential to conduct due diligence, assess risk tolerance, and seek professional advice when necessary. With a clear understanding of Getty Images business fundamentals and investment outlook, investors can position themselves for potential long-term growth and value creation.

Thank you for joining us in exploring the investor insights into Getty Images share price and investment landscape. We hope this analysis has provided valuable perspectives and guidance for your investment decisions.

For further inquiries or assistance, feel free to reach out to Getty Images investor relations team or consult with a financial advisor.