1. Introduction

Welcome to the world of investing, where opportunities to grow your wealth abound. In this blog post, we will explore one intriguing avenue: Investing in Adobe Stock. Adobe Stock is not just a software company; it's also a potential investment vehicle that can yield substantial returns if approached with the right knowledge and strategies.

Whether you are a seasoned investor looking to diversify your portfolio or someone new to the investment landscape, this article will provide you with essential insights into the world of Adobe Stock investments. By the end of this journey, you'll have a better understanding of what Adobe Stock entails and why it may be a promising addition to your investment portfolio.

Also Read This: Uploading Vector to Adobe Stock: Simple Steps

2. Adobe Stock Overview

Before delving into the specifics of investing in Adobe Stock, it's crucial to grasp the fundamentals of what Adobe Stock is and its role in the creative industry.

Adobe Stock is a branch of Adobe Inc., a well-known software company renowned for its creative software solutions like Photoshop, Illustrator, and InDesign. Adobe Stock, however, is not just software; it's a vast collection of high-quality stock photos, videos, illustrations, and other assets used by creatives worldwide to enhance their projects. It functions as a marketplace where content creators can sell their work and businesses or individuals can purchase licenses to use these assets for various purposes.

Here are some key points to consider when understanding Adobe Stock:

- Massive Content Library: Adobe Stock boasts an extensive library of over 200 million assets, making it one of the largest stock content platforms in the world.

- Quality Standards: The assets on Adobe Stock meet high-quality standards, ensuring that customers receive professional-grade content for their creative projects.

- License Types: Adobe Stock offers various license types, including standard and extended licenses, which dictate how content can be used, depending on the buyer's needs.

- Integration with Adobe Creative Cloud: Adobe Stock seamlessly integrates with Adobe Creative Cloud applications, allowing users to browse and license assets without leaving their design software.

For content creators, Adobe Stock provides an opportunity to monetize their creative work by contributing images, videos, and illustrations to the platform. Contributors receive a commission for each sale made, which can be a source of passive income.

In summary, Adobe Stock is more than just a repository of visual content; it's a dynamic marketplace that connects content creators with businesses, marketers, and designers. Understanding the role of Adobe Stock in the creative industry is essential as it sets the stage for exploring the investment potential it offers. In the following sections, we'll dive deeper into why and how you can invest in Adobe Stock effectively.

Also Read This: From Filming to Fortune: Selling Stock Footage on Shutterstock

3. Why Invest in Adobe Stock?

Investing in Adobe Stock can be a lucrative opportunity, but what makes it a compelling choice for investors? Let's explore the reasons why you should consider adding Adobe Stock to your investment portfolio.

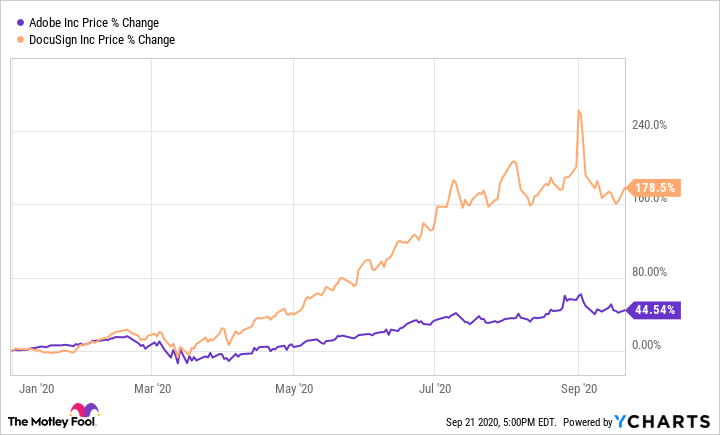

1. Growth Potential: Adobe Inc. has a proven track record of innovation and growth. Its Creative Cloud services, which encompass Adobe Stock, are widely used by professionals and businesses worldwide. As the creative industry continues to expand, Adobe's offerings are positioned for substantial growth.

2. Diversification: Diversifying your investment portfolio is a fundamental principle of risk management. Investing in Adobe Stock can diversify your holdings beyond traditional asset classes like stocks and bonds, reducing your portfolio's overall risk.

3. Exposure to the Creative Industry: The creative industry is a major driver of global economic growth. By investing in Adobe Stock, you gain exposure to this thriving sector, which includes advertising, design, photography, and more.

4. Potential for Passive Income: As an investor in Adobe Stock, you can earn passive income by contributing your creative work to the platform. Each time someone licenses your content, you receive a commission, creating a potential stream of income over time.

5. Demand for Visual Content: In the digital age, the demand for high-quality visual content is on the rise. Businesses and individuals constantly seek images, videos, and illustrations for their websites, marketing materials, and social media. Adobe Stock fulfills this demand, making it a valuable resource for content consumers.

Additionally, let's examine a table that summarizes the potential advantages and considerations of investing in Adobe Stock:

| Advantages | Considerations |

|---|---|

| High growth potential | Market volatility |

| Diversification opportunity | Risk of changes in content trends |

| Exposure to the creative industry | Competition from other contributors |

| Potential for passive income | Market saturation |

| Steady demand for visual content | License restrictions |

It's important to note that like any investment, Adobe Stock carries risks, and it's vital to conduct thorough research and consider your investment goals before diving in. In the following sections, we will explore how to invest in Adobe Stock and the strategies to mitigate potential risks while maximizing returns.

Also Read This: Adobe Stock vs Shutterstock Contributor: Choosing the Right Platform for Your Photos

4. How to Invest in Adobe Stock

Investing in Adobe Stock is an exciting prospect, but it's essential to understand how to get started and the steps involved. Below, we'll guide you through the process of investing in Adobe Stock:

1. Create an Adobe Stock Contributor Account: If you plan to contribute your creative work to Adobe Stock, start by creating a contributor account. You'll need to provide some personal information and submit sample content for review.

2. Review Content Guidelines: Adobe Stock has specific guidelines for content submission. Familiarize yourself with these guidelines to ensure that your work meets the platform's quality and legal standards.

3. Submit High-Quality Content: Once you're approved as a contributor, start uploading your high-quality images, videos, and illustrations to the platform. Quality is crucial, as it affects the likelihood of your content being licensed by buyers.

4. Licensing Options: Adobe Stock offers different licensing options for content. Understand the types of licenses (e.g., standard and extended) and pricing structures to determine how you want to monetize your work.

5. Track Your Earnings: Adobe Stock provides a dashboard for contributors to monitor their earnings. Keep an eye on your sales and earnings to gauge the performance of your content and identify areas for improvement.

6. Purchase Adobe Stock Credits: If you're interested in buying content licenses, you can purchase Adobe Stock credits. Credits allow you to license images, videos, or illustrations as needed, making it a flexible and cost-effective option.

7. Research and Analysis: For investors looking to buy Adobe Stock (ADBE) shares, research the company's financial performance, growth prospects, and market trends. Analyze the stock's historical performance and consider consulting with a financial advisor for insights into your investment strategy.

8. Choose a Brokerage Platform: To buy Adobe Stock shares, you'll need to open an investment account with a reputable brokerage platform. Popular choices include TD Ameritrade, E*TRADE, and Charles Schwab.

Here's a table summarizing the steps for both contributors and investors:

| For Contributors | For Investors |

|---|---|

| Create a Contributor Account | Research Adobe Stock (ADBE) |

| Review Content Guidelines | Choose a Brokerage Platform |

| Submit High-Quality Content | |

| Licensing Options | |

| Track Your Earnings | |

Whether you're contributing content to Adobe Stock or investing in Adobe Stock shares, thorough research and a well-thought-out approach are keys to success. By understanding the process, you can make informed decisions to achieve your investment or creative goals.

Also Read This: Silence Speaks: Disable Comments on DeviantArt

5. Risks and Challenges

While investing in Adobe Stock can offer significant advantages, it's crucial to be aware of the potential risks and challenges associated with this investment. Here are some key considerations:

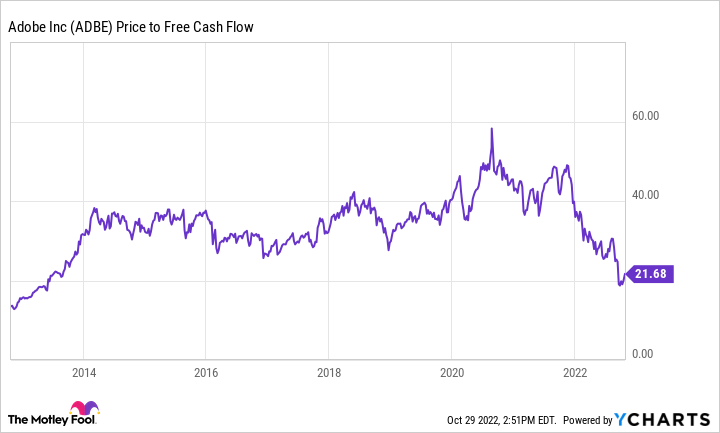

Market Volatility: As with any investment in the stock market, Adobe Stock (ADBE) can experience price fluctuations. Market volatility may impact the value of your investment, and it's important to be prepared for both ups and downs.

Changes in Content Trends: Content trends in the creative industry can shift rapidly. What's popular today may not be in demand tomorrow. Contributors should stay attuned to market trends and adjust their content accordingly to maintain sales levels.

Competition from Other Contributors: Adobe Stock has a vast community of content creators. This means there's intense competition to get your work noticed and licensed. It may take time to build a portfolio and establish a steady income stream.

Market Saturation: As the stock content market grows, it can become saturated with similar content. Buyers have numerous choices, and this can make it challenging to stand out as a contributor. Niche and unique content can help mitigate this challenge.

License Restrictions: Adobe Stock licenses define how content can be used. Content buyers must adhere to these terms. Some content licenses may restrict usage in certain ways, which can affect the appeal and marketability of your content.

Lack of Diversification: For investors, putting all your funds into a single stock, even a reputable one like Adobe, lacks diversification. Diversifying your investment portfolio across various assets helps manage risk and can be a more prudent approach.

Content Review and Approval: As a contributor, your content will go through a review process. There's no guarantee that all your submissions will be approved, and rejections can impact your potential earnings. It's important to meet Adobe Stock's quality and legal standards.

Here's a table summarizing the key risks and challenges of investing in Adobe Stock:

| Risks | Challenges |

|---|---|

| Market Volatility | Changes in Content Trends |

| Competition from Other Contributors | Market Saturation |

| Lack of Diversification | License Restrictions |

| Content Review and Approval |

It's essential for both contributors and investors to recognize and prepare for these risks and challenges. By doing so, you can develop strategies to mitigate potential downsides and make informed decisions regarding your involvement with Adobe Stock.

Also Read This: Increasing Sales on EyeEm: Proven Strategies for Photographers

6. Adobe Stock vs. Other Investment Options

Investors often have a variety of investment options to choose from, and it's essential to evaluate how Adobe Stock compares to other investment opportunities. Let's explore the advantages and disadvantages of investing in Adobe Stock in comparison to traditional investment options.

1. Adobe Stock vs. Stock Market:

Adobe Stock (ADBE) is a single stock investment, whereas the stock market offers a broader range of investment choices. Here's how they compare:

- Adobe Stock: Offers potential growth driven by Adobe's performance and the creative industry. It can provide diversification, but it's limited to one company's performance.

- Stock Market: Provides diversification across various industries and companies, spreading risk. Investors can choose from a wide array of stocks, including large-cap, mid-cap, and small-cap companies.

2. Adobe Stock vs. Bonds:

Bonds are considered a more conservative investment. Here's how Adobe Stock compares to bonds:

- Adobe Stock: Offers the potential for capital appreciation but comes with higher risk due to market volatility.

- Bonds: Tend to be more stable and provide regular interest payments. They are often seen as a lower-risk option, but they may offer lower returns.

3. Adobe Stock vs. Real Estate:

Real estate investments are an alternative asset class. Here's how Adobe Stock stacks up against real estate:

- Adobe Stock: Offers liquidity, meaning you can buy and sell shares relatively quickly. It doesn't require the management and maintenance associated with physical properties.

- Real Estate: Provides potential rental income and property appreciation, but it involves property management, maintenance, and a longer selling process.

It's important to note that each investment option has its own risk-return profile, and the right choice depends on your financial goals, risk tolerance, and investment horizon. Diversifying your investment portfolio by including a mix of asset classes, including stocks, bonds, and potentially Adobe Stock, can help manage risk while potentially enhancing returns.

Here's a table summarizing the key differences between Adobe Stock and other investment options:

| Investment Options | Key Features | Risk-Return Profile |

|---|---|---|

| Adobe Stock | Potential for capital appreciation, single stock investment | Moderate to high risk, potential for high returns |

| Stock Market | Diversification across various companies and industries | Varies based on portfolio composition |

| Bonds | Regular interest payments, lower risk | Lower risk, potentially lower returns |

| Real Estate | Potential rental income and property appreciation | Varies based on property type and location |

Before making any investment decisions, it's advisable to consult with a financial advisor or conduct a thorough analysis of your financial objectives and risk tolerance to determine the most suitable investment option for your portfolio.

Also Read This: WireImage’s Role in Documenting Pop Culture Through the Years

7. Tips for Successful Adobe Stock Investment

For both content contributors and investors, achieving success with Adobe Stock requires careful planning and execution. Here are some tips to help you make the most of your Adobe Stock investment:

1. Content Quality Matters: If you're a content contributor, prioritize quality over quantity. High-quality, unique, and relevant content is more likely to be licensed by buyers.

2. Stay Informed About Trends: Keep an eye on current design and content trends. Content that aligns with popular themes and styles is more likely to be in demand.

3. Consistent Upload Schedule: Regularly contribute new content to your Adobe Stock portfolio. Consistency can lead to increased visibility and potential sales growth.

4. Market to Your Audience: Consider the needs and preferences of your target audience. Create content that addresses their specific requirements to increase the chances of successful licensing.

5. Understand Licensing Options: As a contributor, know the differences between standard and extended licenses. This knowledge helps you set appropriate pricing for your content.

6. Diversify Your Portfolio: Don't put all your creative eggs in one basket. Diversify your content to cater to various customer needs and reach a broader audience.

7. Monitor Performance: Use Adobe Stock's contributor dashboard to track your content's performance. Understand which pieces are popular and which require improvement.

8. Seek Professional Advice: If you're considering investing in Adobe Stock as a financial investment, consult a financial advisor. They can help you make informed decisions based on your financial goals and risk tolerance.

9. Diversify Your Portfolio: If you're an investor, consider diversifying your investment portfolio. Don't put all your resources into a single stock. Diversification can help spread risk.

10. Stay Informed: Keep yourself informed about Adobe Inc.'s financial performance, industry news, and market trends. This knowledge can aid in your investment decision-making process.

11. Set Clear Objectives: Whether you're a contributor or an investor, set clear and achievable objectives. Define what you want to achieve with your involvement in Adobe Stock and measure your progress against these goals.

Here's a table summarizing the key tips for content contributors and investors:

| For Content Contributors | For Investors |

|---|---|

| Content Quality Matters | Seek Professional Advice |

| Stay Informed About Trends | Diversify Your Portfolio |

| Consistent Upload Schedule | Stay Informed |

| Market to Your Audience | Set Clear Objectives |

| Understand Licensing Options | |

| Diversify Your Portfolio | |

| Monitor Performance |

By following these tips and adapting them to your specific goals and circumstances, you can increase your chances of success as a content contributor or investor in Adobe Stock. Remember that patience and persistence are often key factors in achieving long-term success.

Underwater Life

Surreal scene in an autumnal forest pic.twitter.com/QW5sy0cBKb

— Markus Stock Photography (@MarkusStockPho1) October 26, 2023

Also Read This: Seamless Shopping: A Consumer’s Guide to Shopify

Frequently Asked Questions (FAQ)

Here are some common questions that individuals often have about Adobe Stock investments:

Q1: What is the minimum investment required to start with Adobe Stock?

A1: There is no minimum investment requirement for contributing content to Adobe Stock. Content contributors can start by creating an account and uploading their work, which can be done for free. For investors, the minimum investment amount would depend on the current share price of Adobe Stock (ADBE).

Q2: How do I get paid as a content contributor on Adobe Stock?

A2: Contributors receive payments when their content is licensed by buyers. Earnings are accumulated in your Adobe Stock contributor account and can be withdrawn through various payment methods, including PayPal and Skrill.

Q3: Is Adobe Stock a reliable investment option?

A3: Adobe Stock can be a reliable investment option, but like all investments, it carries risks. It's crucial to conduct thorough research, assess your investment goals, and consult with a financial advisor to determine if it aligns with your overall financial strategy.

Q4: Can I contribute content if I'm not a professional photographer or designer?

A4: Absolutely! Adobe Stock welcomes a wide range of content creators. Whether you're a professional or an amateur, you can contribute content as long as it meets Adobe Stock's quality and legal standards.

Q5: Are there any restrictions on how I can use content licensed from Adobe Stock?

A5: Yes, Adobe Stock licenses dictate how content can be used. It's essential for buyers to review the terms and conditions associated with the specific license they purchase to ensure compliance with usage restrictions.

Q6: How can I monitor the performance of Adobe Stock shares if I'm an investor?

A6: To monitor the performance of Adobe Stock shares, you can use financial news websites, stock market apps, and the Adobe Investor Relations website. These sources provide information on stock prices, earnings reports, and company updates.

Q7: Can I invest in Adobe Stock if I'm not a professional investor?

A7: Yes, you can invest in Adobe Stock even if you're not a professional investor. Many brokerage platforms offer user-friendly interfaces that make it accessible for individuals to buy and sell stocks, including Adobe Stock (ADBE).

These frequently asked questions aim to address common queries that individuals may have about Adobe Stock contributions and investments. If you have more specific or detailed questions, it's advisable to seek guidance from Adobe Stock's official resources or consult with financial professionals for investment-related queries.

Conclusion

In conclusion, investing in Adobe Stock presents a unique opportunity that combines creative content contribution with financial investment. Whether you're a content creator looking to monetize your work or an investor seeking to add Adobe Stock (ADBE) shares to your portfolio, it's important to approach this venture with knowledge and careful consideration.

Adobe Stock is more than just a stock content platform; it's a marketplace that connects creative content creators with businesses and individuals in need of high-quality visual assets. Its vast library and seamless integration with Adobe Creative Cloud make it a valuable resource in the creative industry.

As an investor, evaluating Adobe Stock as a potential addition to your portfolio involves understanding Adobe Inc.'s financial performance, industry trends, and the risks associated with stock market investments. Diversification and a long-term perspective are key factors in managing risk and potential returns.

For content contributors, quality, relevance, and consistency are essential in building a successful portfolio. Staying informed about design trends and market demands can help increase the likelihood of content licensing and earning revenue. Regularly monitoring the performance of your content and adjusting your strategy accordingly is also crucial.

While Adobe Stock offers opportunities, it's essential to be aware of the risks and challenges associated with content contribution and stock investment. Market volatility, content trends, competition, and licensing restrictions are factors to consider.

By following the tips provided in this guide and understanding the factors at play, you can navigate the world of Adobe Stock effectively and make informed decisions. Whether you're contributing content or investing in Adobe Stock, success often comes with persistence, adaptability, and a commitment to quality.

We hope that this guide has been informative and assists you in your journey as a contributor or investor in Adobe Stock. Remember that ongoing learning and adaptation are key to prospering in the ever-evolving landscape of creative content and financial markets.