When it comes to understanding how stock shares are distributed to directors, it can feel a bit like peeling an onion—layer upon layer of processes and policies. The distribution of stock shares is a crucial aspect of corporate governance and serves as a key incentive for directors to align their interests with those of shareholders.

Typically, stock shares are distributed to directors through several mechanisms:

- Direct Stock Grants: Some companies grant shares directly to directors as part of their compensation package. This can be a one-time grant or part of a regular compensation strategy.

- Stock Options: Directors may be offered stock options, which give them the right to purchase shares at a predetermined price. This approach can motivate directors to enhance the company’s performance, as the value of their options increases with the company’s stock price.

- Restricted Stock Units (RSUs): RSUs are shares that are granted but come with restrictions, such as vesting periods. This means that directors do not actually own the shares until certain conditions are met.

Moreover, the distribution process is often influenced by various factors, including:

| Factor | Description |

|---|---|

| Company Performance | Higher performance may lead to more favorable share distributions. |

| Market Conditions | Economic climate can impact stock availability and value. |

| Regulatory Compliance | Legal frameworks dictate how shares can be distributed. |

In essence, the distribution of stock shares to directors is a balancing act, designed to incentivize performance while adhering to regulations and maintaining fairness within the company.

4. How Stock Options Work for Directors

Stock options are a popular way to compensate directors and incentivize them to focus on long-term success. But how exactly do stock options work? Let’s break it down in a way that’s easy to understand.

Stock options give directors the right, but not the obligation, to buy a specified number of shares at a predetermined price, known as the exercise price, within a certain timeframe. Here’s a simple rundown of how it typically works:

- Grant Date: This is when the company grants the stock options to the directors. It’s the starting point of the option’s lifecycle.

- Vesting Period: Most options come with a vesting schedule, meaning directors must wait a specific period before they can exercise their options. This can be a way to ensure that directors stay with the company and contribute to its growth.

- Exercise: Once the options are vested, directors can choose to exercise their options, which means they can buy the shares at the exercise price. If the current market price is higher than the exercise price, it’s a great opportunity to buy at a discount!

- Expiration: Stock options usually have an expiration date, after which they can no longer be exercised. Directors need to be mindful of this to avoid losing their rights to purchase shares.

To illustrate, think of stock options as a ticket to a concert. You buy a ticket (exercise price) to see your favorite band (company) perform. If the concert becomes super popular (the stock price goes up), your ticket allows you to enjoy the show at the original price. However, if you miss the concert (let the options expire), you lose out on the opportunity.

In summary, stock options for directors not only serve as a financial incentive but also foster a sense of ownership and commitment to the company's future. Understanding how they work is key to appreciating their role in corporate governance.

Also Read This: How to Create a Subscribe Link on YouTube

5. Factors Influencing Stock Share Allocation

When it comes to stock share allocation for directors, several factors come into play. Understanding these elements can help demystify how and why directors receive the shares they do. Let's break it down!

- Company Performance: The overall health of the company is a major factor. If a company is thriving, directors might receive more shares as a reward for their contributions to that success.

- Market Conditions: Economic conditions and market trends influence stock prices and allocations. In a booming market, companies may offer more shares to attract and retain top talent, while in a downturn, they might scale back.

- Director's Role: The responsibilities and influence of a director can also affect their share allocation. For instance, a director involved in strategic decision-making or operational leadership might receive a larger share compared to others.

- Incentive Structure: Companies often have different incentive plans that dictate how many shares are allocated. This could include performance-based incentives that reward directors for meeting specific goals.

- Industry Standards: The norms and practices within the industry can set expectations for stock share allocations. Companies often benchmark against competitors to remain attractive to potential directors.

Understanding these factors is crucial for directors as they navigate their roles and assess their compensation packages.

Also Read This: Download Getty Images for Free and Legally Without Copyright Issues

6. Implications of Stock Ownership for Directors

Stock ownership can have profound implications for directors, affecting not only their financial well-being but also their decision-making and the overall governance of the company.

| Implication | Description |

|---|---|

| Alignment of Interests: | When directors own stock, their interests align more closely with shareholders. They are likely to make decisions that positively impact share prices and, consequently, their own financial rewards. |

| Potential Conflicts of Interest: | While alignment can be beneficial, it may also lead to conflicts of interest. Directors might prioritize short-term gains over long-term sustainability if their compensation is heavily tied to stock performance. |

| Increased Accountability: | Directors with a significant ownership stake may feel more accountable for their decisions. They are directly affected by the consequences of their actions, fostering a sense of responsibility. |

| Impact on Decision-Making: | Stock ownership can influence the way directors approach strategic decisions. They might be more inclined to support initiatives that boost shareholder value, even if those decisions are risky. |

| Public Perception: | How much stock a director owns can shape public perception. A high level of ownership can boost confidence among investors, while a lack of ownership may raise concerns about commitment. |

In summary, stock ownership for directors isn't just about financial gains; it shapes their mindset, responsibilities, and the broader dynamics within the company. Understanding these implications is vital for directors as they navigate their roles.

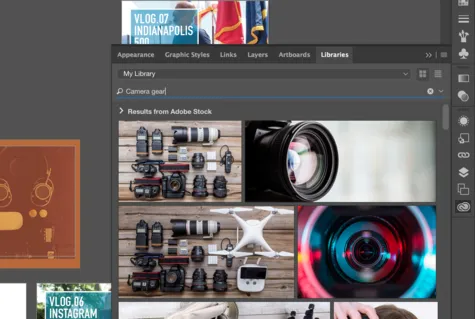

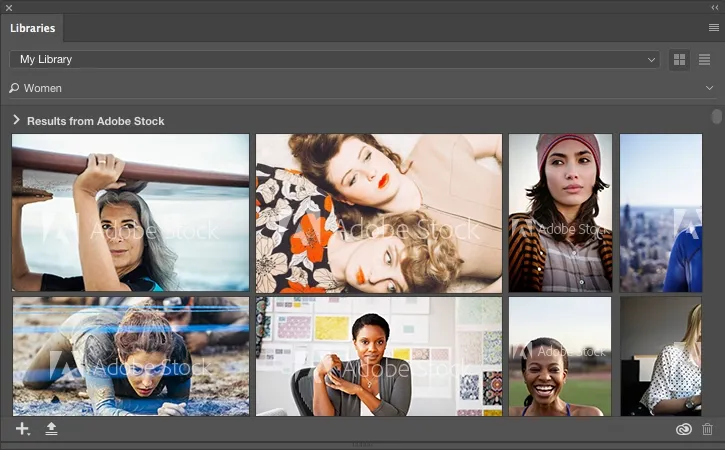

Understanding Adobe Stock Shares for Directors and Their Functionality

Adobe Stock Shares are an essential aspect of corporate governance, particularly for directors who play a pivotal role in the strategic direction of the company. These shares not only represent ownership in Adobe but also come with specific rights and responsibilities that can impact decision-making processes.

Here are some key functionalities and aspects of Adobe Stock Shares for directors:

- Voting Rights: Directors holding stock shares have the right to vote on significant corporate matters, including mergers, acquisitions, and changes in corporate policies.

- Dividends: Stock shares may offer dividends, which are a portion of the company’s earnings distributed to shareholders. This can incentivize directors to make decisions that enhance company profitability.

- Equity Compensation: Many directors receive stock shares as part of their compensation package, aligning their interests with those of shareholders and motivating them to increase company value.

- Long-term Commitment: Holding stock shares encourages directors to focus on long-term strategies rather than short-term gains, fostering sustainable growth.

In addition, the functionality of stock shares can be illustrated in the following table:

| Functionality | Description |

|---|---|

| Ownership | Represents a stake in the company. |

| Influence | Ability to affect company decisions through voting. |

| Financial Incentive | Potential for dividends and capital appreciation. |

| Alignment of Interests | Directors' interests align with those of shareholders. |

In conclusion, stock shares are a vital component of corporate governance, enabling directors to contribute effectively to the company's strategic objectives while ensuring accountability and alignment with shareholder interests.