In the era, providing payment choices can significantly impact your business. PayPal Credit stands out as an option that not only draws in customers but also enriches their buying journey. Picture a customer looking to schedule a session but holding back due to budget limitations. Thanks to PayPal Credit they can secure what they need right away and settle the payment later alleviating their concerns and motivating them to complete the booking.

PayPal Credit offers several benefits:

- Flexible Payments: Clients can make large purchases and pay them off over time.

- Quick Approval: The application process is simple and fast, often completed in minutes.

- No Interest if Paid in Full: For purchases over a certain amount, clients can enjoy no interest if they pay in full within six months.

- Enhanced Customer Trust: Offering PayPal as a payment option adds credibility to your business.

As someone who captures moments through photography I recall a heartfelt moment when a client shared her appreciation upon finding out about this payment choice. It not eased her worries but also gave her the opportunity to indulge in a top notch package she had been considering. That experience truly highlighted for me the importance of offering such options in our ventures.

How to Set Up PayPal Credit on ShootProof

Linking PayPal Credit to your ShootProof account is a simple process that can be done in a few easy steps. To get started make sure you have a PayPal Business account. If you haven't set one up yet no need to fret creating an account is a breeze and comes at no cost!

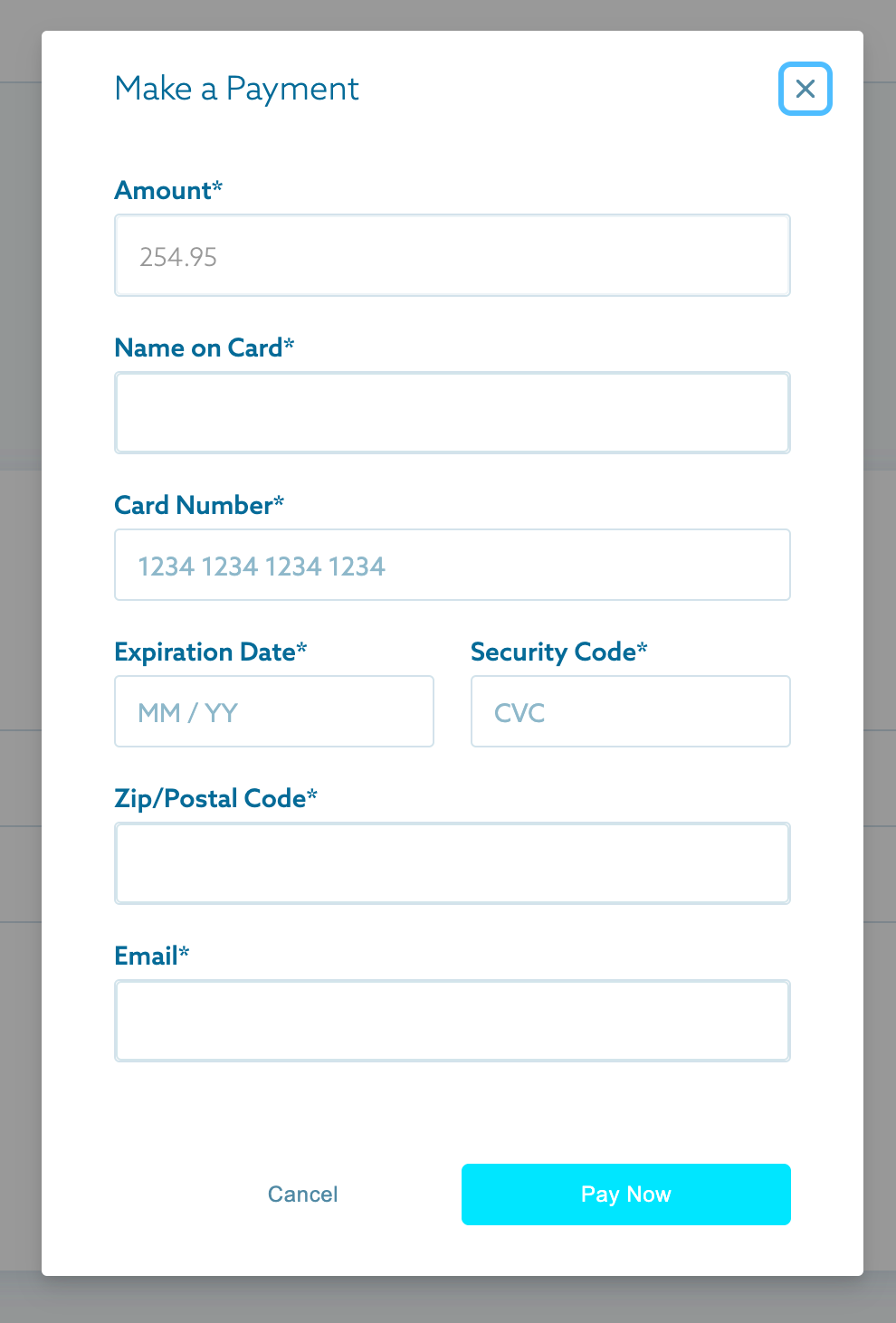

Follow these steps:

- Log in to your ShootProof account.

- Go to the “Payment Settings” section.

- Select “PayPal” as your payment option.

- Connect your PayPal Business account by entering the required credentials.

- Enable PayPal Credit in the payment settings.

After finishing these steps your customers will have the option to use PayPal Credit at checkout. This added convenience is expected to boost the number of bookings and increase the value of purchases.

Also Read This: Maximize Your Contribution by Adding Photos to Adobe Stock from Lightroom

Integrating PayPal Credit with Your ShootProof Account

Linking PayPal Credit to your ShootProof account goes beyond adding a payment option; it enriches the entire experience for your clients. Offering them choices instills confidence and motivates them to make larger purchases.

To seamlessly incorporate PayPal Credit take into account the following aspects.

- Display Clear Information: Ensure that the PayPal Credit option is clearly visible on your payment page. Use simple language to explain how it works.

- Promote the Benefits: Mention the advantages of using PayPal Credit in your marketing materials—whether it's through email newsletters or social media posts.

- Engage with Clients: Reach out to your clients to inform them about this new payment option. A personal touch can make a world of difference.

Based on what I've seen, spreading the word about PayPal Credit availability has resulted in a significant boost in conversion rates. One of my clients shared with me that learning about PayPal Credit made her feel more comfortable choosing a premium package that she originally believed was beyond her financial means. This highlights the positive effect that providing payment alternatives can bring!

Also Read This: Sign Up for Telegram Without Your Phone Number

Steps to Offer PayPal Credit to Your Clients

As someone in the field of photography I recognize the importance of providing clients with payment choices. Introducing PayPal Credit goes beyond being a mere service; it acts as a support system that assists clients in overcoming financial doubts and seizing opportunities. Now you might wonder how to present this option to your clients? Here are a few straightforward steps to guide you.

- Inform Your Clients: Begin by informing your clients that you now accept PayPal Credit. This can be done through email newsletters, your website, or even during your consultation calls. Personalize your message by sharing how this option could benefit them.

- Explain the Process: Make sure clients understand how to use PayPal Credit. Provide them with a brief overview of the application process and the benefits, such as flexible payment terms and potential interest-free periods.

- Incorporate It into Your Pricing: When you send out price lists or quotes, highlight PayPal Credit as a payment option. This could encourage clients who might be on the fence to go for higher packages.

- Follow Up: After your clients express interest, follow up to remind them about this payment option. A simple nudge can often lead to a booking.

When I brought up PayPal Credit for the first time I noticed a quick change in how clients reacted. One soon to be bride expressed her relief at having the flexibility to handle payments more efficiently. It really simplified her choice to choose me as her vendor.

Also Read This: Linking YouTube Music to Alexa with Ease

Promoting PayPal Credit as a Payment Option

When it comes to showcasing PayPal Credit as a payment choice, promotion plays a role. Simply providing the option isn't sufficient; you need to inform your customers about its existence and the advantages it offers. Here are some strategies to promote it effectively:

- Utilize Social Media: Share posts on platforms like Instagram and Facebook showcasing the convenience of PayPal Credit. Use engaging visuals and simple explanations to capture attention.

- Feature It on Your Website: Create a dedicated section on your website detailing PayPal Credit. Use real-life examples of how clients have benefitted from using it.

- Client Testimonials: Encourage satisfied clients to share their experiences with PayPal Credit. Word of mouth is powerful, and personal stories resonate deeply with potential clients.

- Offer Limited-Time Promotions: Create urgency by offering discounts for clients who choose to use PayPal Credit during specific periods. This tactic can encourage hesitant clients to take the plunge.

In my previous marketing push I shared a story about a client who managed to secure a photoshoot through the help of PayPal Credit. The feedback was incredibly encouraging showcasing the emotional aspect of choices. People valued the authenticity and genuine narratives that accompanied the message.

Also Read This: Canva Image Replacement

Common Issues and Troubleshooting Tips

Although PayPal Credit is a great choice for people it does come with its fair share of challenges. Being ready to tackle these issues can assist you in preserving customer confidence and ensuring seamless transactions. Here are a few problems that frequently arise and suggestions on how to handle them.

- Application Denied: If a client’s application for PayPal Credit is denied, encourage them to check their credit report for errors or to improve their credit score before reapplying. You can suggest alternatives such as a payment plan through your business.

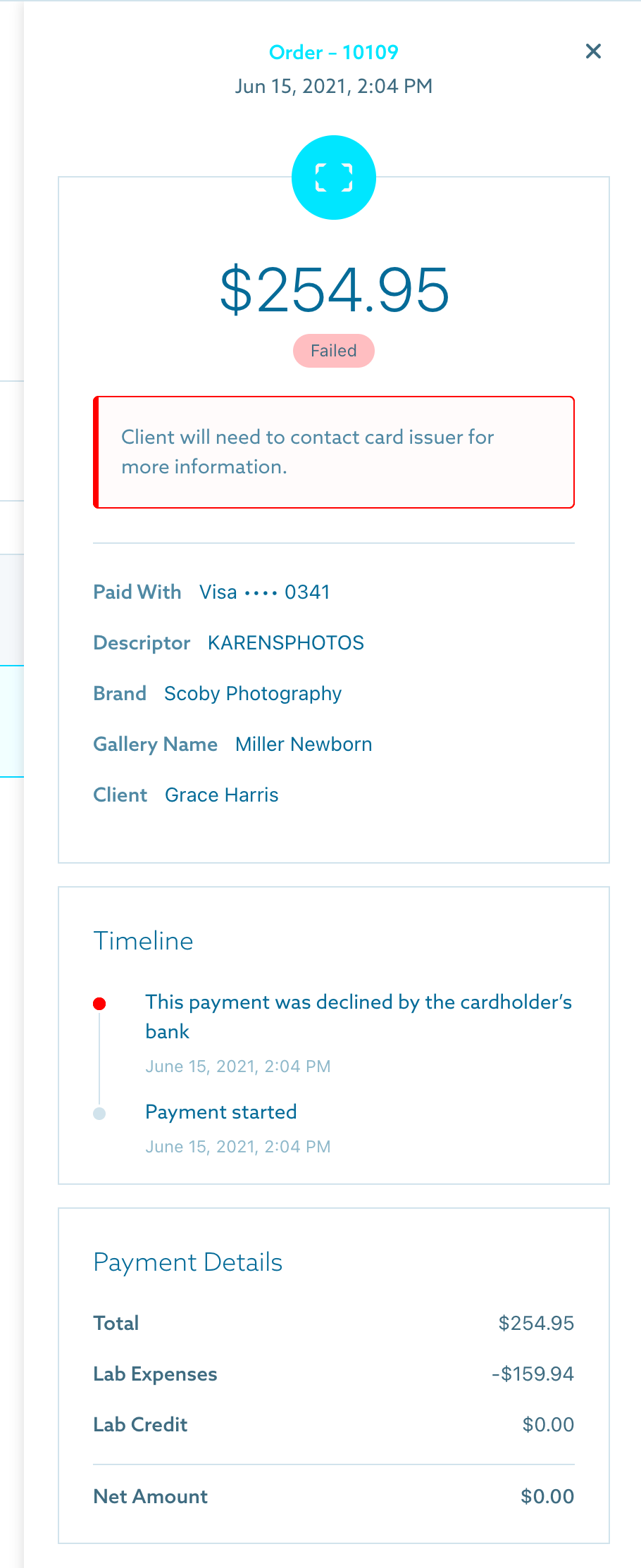

- Technical Glitches: Sometimes clients may face issues during the checkout process. Ensure you have a reliable support channel for them to reach out to you with any concerns, and provide quick responses to resolve their issues.

- Payment Delays: If payments are delayed, reassure your clients that these issues can happen but often resolve quickly. Encourage them to keep track of their payment status through their PayPal account.

When I began using PayPal Credit I encountered some bumps along the way. One of my clients had difficulty finding the payment option at checkout. However with prompt assistance and support I not only resolved the problem but also demonstrated my dedication to customer service. Each obstacle presents a chance to enhance client connections!

Also Read This: Canva Layering Images

How PayPal Credit Can Enhance Your Business

In the realm of photography and creative services the availability of payment options can truly make a difference. PayPal Credit isn’t merely an addition; it serves as a potent resource that can greatly benefit your business. When I initially introduced this choice I observed a noticeable change in my clients receptiveness to funding their envisioned projects. It felt as though I was opening up a pathway to opportunities.

Here are a few ways that PayPal Credit can benefit your business.

- Increased Sales: By offering flexible payment terms, clients are more likely to make larger purchases. They can opt for that beautiful album or extended session without the immediate financial burden.

- Attracting New Clients: Many potential clients may be hesitant to book services due to budget constraints. When they see that you offer PayPal Credit, it removes that barrier and encourages them to move forward.

- Improved Customer Loyalty: Providing flexible payment options makes clients feel valued. When they have a positive experience, they are more likely to return for future services and recommend you to others.

- Streamlined Transactions: With PayPal’s trusted platform, clients feel secure making transactions, which can speed up the booking process.

After introducing PayPal Credit I had a client who was initially unsure about scheduling a family portrait session. However once she discovered the flexibility in payments she not only went ahead and booked the session but also decided to upgrade to a package that came with a beautiful canvas print. This is the type of impact that PayPal Credit can have!

Also Read This: Understanding How to View Someone's YouTube Subscriptions

Frequently Asked Questions

When introducing a service like PayPal Credit it's normal for customers to have inquiries. Here are a few of the questions along with straightforward responses to assist you in your discussions with clients.

- What is PayPal Credit? PayPal Credit is a digital line of credit that allows clients to make purchases and pay for them over time, often with special financing options.

- How do I apply for PayPal Credit? Clients can apply online through their PayPal account or during the checkout process on your site. The approval process is typically quick, often taking just a few minutes.

- What happens if I miss a payment? It’s important to inform clients that late payments may incur fees and could affect their credit score. Encourage them to keep track of their payment schedule.

- Can I use PayPal Credit for all purchases? Clients can use PayPal Credit for eligible purchases, but they should check the terms and conditions on the PayPal site for details.

When I rolled out PayPal Credit for the time I put together a set of frequently asked questions to preemptively tackle client queries. This had an impact on the level of comfort clients had with adopting this payment option.

Conclusion: Maximizing Your Payment Options with PayPal Credit

To sum up introducing PayPal Credit is not only a strategic decision but also an opportunity to establish a stronger bond with your customers. In my experience as a photographer I have witnessed how convenient payment choices can remove obstacles and nurture enduring connections. Its about fostering an atmosphere where clients feel encouraged to chase their aspirations without any reservations.

In order to fully leverage the advantages of PayPal Credit.

- Be Proactive: Regularly remind clients about this option through various communication channels.

- Gather Feedback: After clients use PayPal Credit, ask for feedback to improve the experience and address any concerns they might have.

- Stay Informed: Keep yourself updated on any changes to PayPal’s terms and offerings to provide the best service possible.

Looking back on my path as a photographer I see that even the smallest adjustments make a difference. Introducing PayPal Credit has not enhanced my sales but also strengthened my connections with clients making them feel appreciated and understood. So go ahead and offer PayPal Credit your clients will be grateful for it!