Investing in Adobe stock can be an exciting venture for both seasoned investors and newcomers alike. With the rise of technology and digital media, Adobe has carved out a niche that offers both stability and growth potential. In this section, we’ll explore why investing in Adobe stock is a fantastic opportunity and how you can get started. Whether you’re looking to diversify your portfolio or dive into the world of tech investments, understanding Adobe's market position and growth prospects is crucial.

Overview of Adobe as a Company

Founded in 1982, Adobe Inc. has become a household name, particularly in the realms of digital media and marketing solutions. The company is renowned for its flagship products like Photoshop, Illustrator, and Adobe Acrobat, which have transformed the way creative professionals work. Over the years, Adobe has expanded its offerings to include cloud-based solutions, further solidifying its position in the market.

Here’s a quick overview of Adobe’s key offerings:

- Creative Cloud: A suite of applications and services for design, video editing, web development, photography, and more.

- Document Cloud: Services for creating, editing, and sharing PDF documents online.

- Experience Cloud: A set of tools for marketing, advertising, analytics, and commerce that helps businesses manage their customer experiences.

Adobe has a strong business model based on subscriptions rather than one-time purchases, which has proved to be a stable revenue stream. This recurring revenue model allows the company to maintain consistent growth and adapt to changing market demands.

Here are some key financial metrics that highlight Adobe's performance:

| Metric | Value |

|---|---|

| Market Capitalization | $200 billion (approx.) |

| Annual Revenue (2023) | $17 billion (approx.) |

| Growth Rate (YoY) | 15% |

As a key player in the digital transformation space, Adobe's innovative solutions and continuous investment in research and development position it favorably for future growth. Understanding the essence of Adobe as a company not only helps in grasping its stock potential but also in appreciating its role in the broader tech landscape.

Also Read This: Accessing YES Network on YouTube TV

The Benefits of Investing in Adobe Stock

Investing in Adobe stock can be a rewarding endeavor, especially when you consider the company's strong market position and innovative products. Here are some notable benefits:

- Robust Financial Performance: Adobe has consistently shown strong revenue growth, driven by its successful transition to a subscription-based model. This means predictable and recurring revenue, which is often attractive to investors.

- Diverse Product Portfolio: Adobe's offerings, such as Photoshop, Illustrator, and Adobe Experience Cloud, cater to a wide range of industries. This diversity helps mitigate risks associated with market fluctuations in any single sector.

- Strong Brand Loyalty: Adobe has built a strong brand over decades. Their software is widely used by professionals, which creates a loyal customer base that is less likely to switch to competitors.

- Innovation and Adaptation: Adobe invests heavily in R&D, ensuring its products remain at the forefront of technology trends. Their commitment to innovation helps maintain a competitive edge.

- Attractive Dividends: Adobe has a history of returning value to shareholders through dividends. This can be an added incentive for long-term investors looking for income.

Overall, investing in Adobe stock offers a combination of financial stability, growth potential, and a strong market presence, making it an attractive option for both novice and experienced investors.

Also Read This: How to Use Transparent Vector Files from Shutterstock in Your Projects

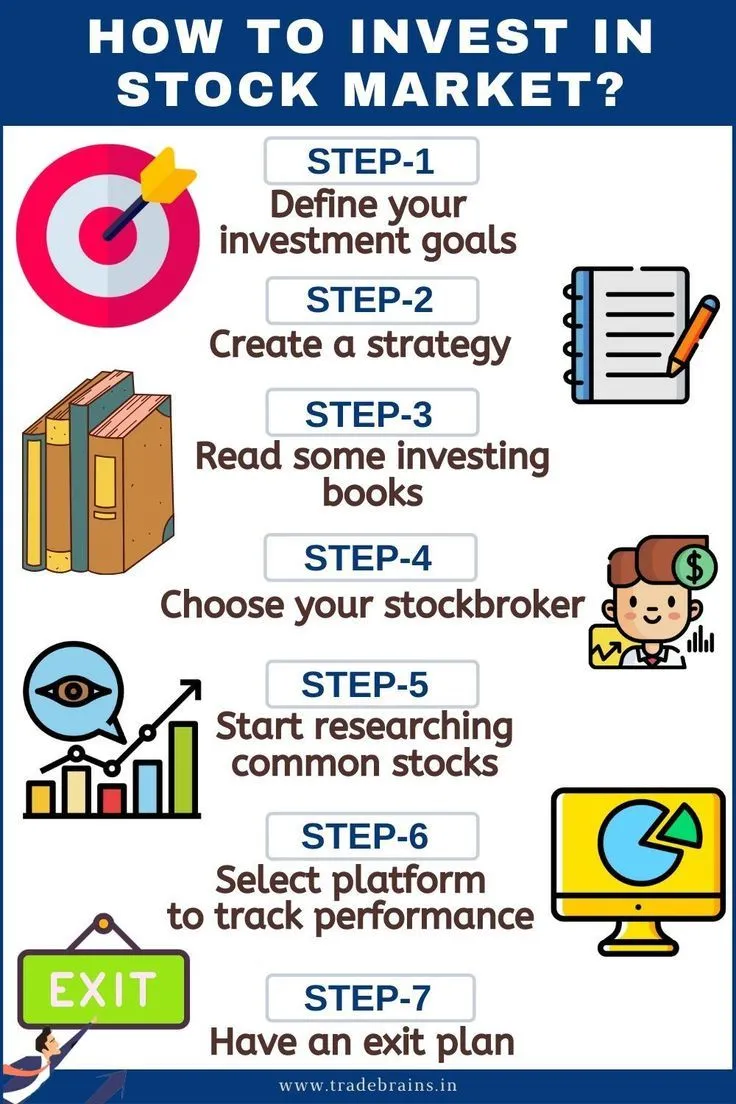

How to Start Investing in Adobe Stock

Ready to dive into the world of investing in Adobe stock? Here’s a step-by-step guide to get you started:

- Educate Yourself: Understand the basics of stock investing, including concepts like market orders, limit orders, and how to read stock charts. Knowledge is power!

- Choose a Brokerage: Select a brokerage platform that suits your investing style. Popular options include:

| Brokerage | Fees | Features |

|---|---|---|

| Robinhood | No commission | User-friendly app |

| ETRADE | Low commission | Research tools |

| Fidelity | No commission | Great customer service |

- Create an Account: Sign up for your chosen brokerage. You’ll need to provide some personal information and link your bank account.

- Fund Your Account: Transfer money into your brokerage account. Make sure you’re comfortable with the amount you’re investing.

- Research Adobe Stock: Look into Adobe’s financials, recent news, and market trends. Understanding the company will help you make informed decisions.

- Place Your Order: Decide how many shares of Adobe you want to buy and place your order through your brokerage platform.

- Monitor Your Investment: Keep an eye on your investment’s performance and stay updated on company news. Adjust your strategy as necessary.

Starting to invest in Adobe stock is easier than you might think! With some research and a solid plan, you can take your first steps toward building a potentially rewarding investment portfolio.

Also Read This: Understanding the Duration of the Royal Rumble Pay-Per-View Event

Strategies for Successful Stock Market Investment

Investing in the stock market can be both exciting and daunting, but having a solid strategy can make all the difference. Here are some effective strategies to consider when investing in Adobe stock or any other stock:

- Research and Analysis: Before diving into any investment, it's crucial to do your homework. Look into Adobe's financial health, its market position, and future growth prospects. Analyze their earnings reports, revenue growth, and competitive advantages.

- Diversification: Don’t put all your eggs in one basket! Diversifying your portfolio can help mitigate risks. Invest in a mix of sectors or asset classes to cushion against market volatility.

- Long-Term Perspective: Stock markets can be unpredictable in the short term. Adopting a long-term approach allows you to ride out volatility and benefit from the overall growth of the company and the market.

- Set Clear Goals: Determine what you want to achieve with your investments. Are you looking for capital appreciation, dividends, or a combination? Having clear objectives can guide your investment choices.

- Regular Monitoring: Keep an eye on your investments. Regularly review your portfolio and make adjustments as necessary based on market conditions and your financial goals.

By following these strategies, you can set yourself up for successful stock market investment, making informed decisions that can lead to fruitful outcomes.

Also Read This: Step by Step Guide to Making Pasta

Risks Associated with Investing in Adobe Stock

While investing in Adobe stock can be rewarding, it's essential to be aware of the risks involved. Here are some key risks to consider:

| Risk Type | Description |

|---|---|

| Market Volatility | Adobe stock, like all stocks, is subject to fluctuations based on market conditions. Economic downturns or sudden market shifts can impact stock prices significantly. |

| Company-Specific Risks | Factors such as management decisions, product launches, or legal issues can affect Adobe's performance and, consequently, its stock price. |

| Technological Changes | The tech industry is fast-paced. If Adobe fails to innovate or adapt to new technologies, it may lose its competitive edge, impacting its stock value. |

| Regulatory Risks | Changes in regulations or compliance issues can pose risks to Adobe's business model and profitability. |

| Economic Factors | Global economic conditions, interest rates, and inflation can influence market performance and investor sentiment. |

Understanding these risks is vital in making informed investment decisions in Adobe stock. By being aware of potential pitfalls, you can better strategize and prepare for the highs and lows of the stock market.

How to Invest in Adobe Stock and Understand the Benefits of Stock Market Investment

Investing in Adobe stock can be an excellent opportunity for those looking to diversify their portfolio and benefit from the growth of a leading software company. Adobe Inc., known for its creative software products like Photoshop, Illustrator, and Adobe Acrobat, has demonstrated consistent growth and innovation. Below are some key steps and benefits of investing in Adobe stock.

Steps to Invest in Adobe Stock

- Research Adobe's Financial Health: Before investing, review Adobe's financial statements, earnings reports, and market trends.

- Choose a Brokerage: Select a reputable online brokerage platform, such as Charles Schwab, ETRADE, or Robinhood, that allows you to buy stocks.

- Create an Account: Set up an account with your chosen brokerage, providing necessary identification and financial information.

- Fund Your Account: Transfer funds into your brokerage account to enable stock purchases.

- Place Your Order: Search for Adobe's stock ticker symbol, ADBE, and place a buy order at your preferred price.

- Monitor Your Investment: Keep track of Adobe's stock performance and market news to make informed decisions regarding your investment.

Benefits of Investing in Adobe Stock

- Long-term Growth Potential: Adobe's continuous innovation and expansion into new markets can lead to significant long-term gains.

- Dividend Opportunities: Adobe occasionally pays dividends, providing investors with regular income.

- Market Leader: As a leader in digital media and marketing solutions, Adobe is well-positioned in a growing industry.

- Diversification: Investing in Adobe can diversify your portfolio, balancing other investments.

In conclusion, making informed investment decisions requires thorough research and understanding of the stock market dynamics. By investing in Adobe stock, you not only support a reputable company but also position yourself to potentially reap financial rewards in the long run.