Shutterstock offers several payment methods to ensure that contributors can easily receive their earnings. Knowing how these methods work can help you choose the best option for your needs. Whether you are a photographer, videographer, or illustrator, understanding these methods is key to managing your finances effectively.

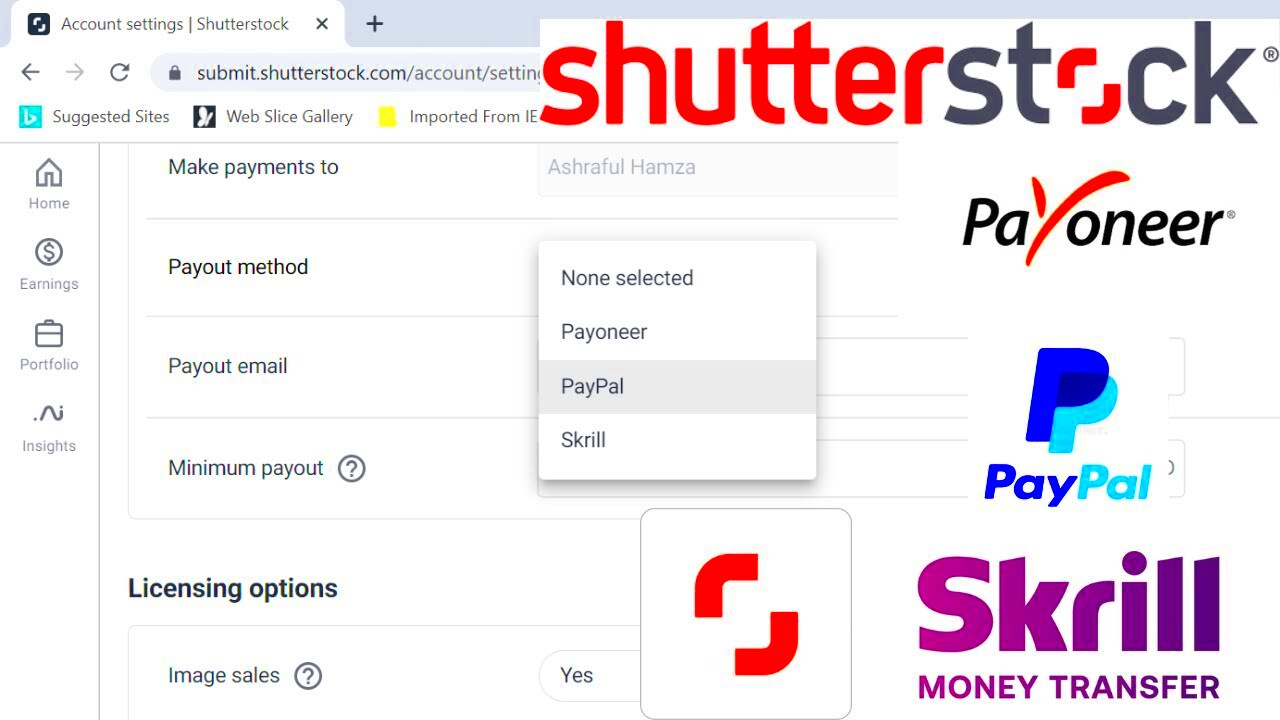

Here are the main payment methods available on Shutterstock:

- PayPal: A popular and widely used option that allows quick transactions.

- Direct Deposit: Funds are directly deposited into your bank account, which is convenient for regular earnings.

- Checks: Although less common nowadays, checks can be mailed to you if requested.

Each method has its own pros and cons. For instance, PayPal transactions are generally instant, but fees may apply. Direct deposit can take a bit longer but is secure and reliable. Choosing the right method depends on your preferences and financial situation.

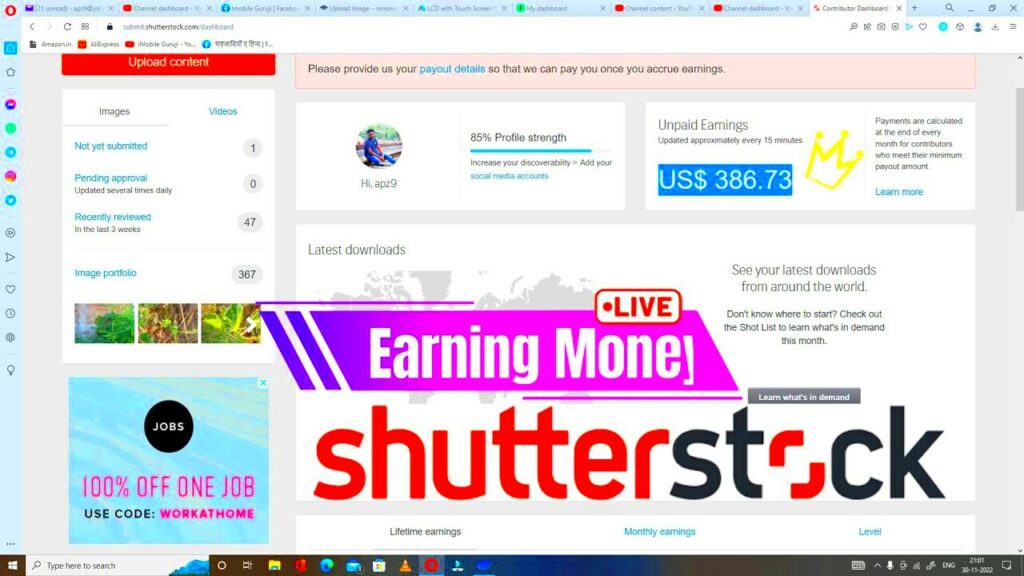

How Earnings Are Calculated on Shutterstock

Understanding how your earnings are calculated on Shutterstock can help you maximize your income. Shutterstock pays contributors based on a commission model, which means your earnings depend on various factors, including:

- Type of Content: Different types of content have different pricing. For example, photos usually earn less than videos.

- Subscription vs. On-Demand Sales: Earnings can vary depending on whether customers purchase your content through a subscription or an individual download.

- Your Contributor Level: As you upload more content and gain sales, you can move up levels, increasing your commission rates.

Shutterstock also uses a sliding scale for payouts, meaning the more you sell, the higher your earnings per download. Keeping track of your sales and knowing which types of content perform best can help you strategize for better earnings.

Also Read This: How to Go Live on Behance

Receiving Payments Through PayPal

PayPal is one of the most convenient methods for receiving payments from Shutterstock. If you choose this option, you can expect quick transfers and easy access to your funds. Here’s how it works:

- Linking Your PayPal Account: You need to link your PayPal account to your Shutterstock profile. This can be done in your account settings.

- Transaction Time: Once your earnings are processed, they usually appear in your PayPal account within a few hours, making it a fast option.

- Fees: Be aware that PayPal may charge fees for receiving money, especially for international transactions. Check their fee structure to understand what to expect.

Using PayPal also provides flexibility. You can transfer your earnings to your bank account or use them for online purchases. Just make sure to keep your account secure to avoid any issues with your earnings.

Also Read This: Creating a Facebook ID Without Using Phone Numbers on Dailymotion

Using Direct Deposit for Earnings

Direct deposit is a reliable and efficient way to receive your earnings from Shutterstock. It eliminates the hassle of waiting for checks or transferring funds manually, making it a favorite among many contributors. By setting up direct deposit, you can enjoy seamless access to your earnings.

Here’s how direct deposit works with Shutterstock:

- Setup Process: To set up direct deposit, go to your Shutterstock account settings and enter your bank account details. Make sure the information is accurate to avoid delays.

- Processing Time: Once your earnings are processed, it typically takes 2 to 5 business days for the funds to appear in your account. This timeframe can vary based on your bank.

- Security: Direct deposit is secure, reducing the risk of lost or stolen checks. As long as your bank information is safe, you won’t have to worry about payment issues.

By choosing direct deposit, you can streamline your payment process and manage your finances more efficiently. Just keep an eye on your bank account to ensure you receive your earnings on time.

Also Read This: Mastering Company Tagging in LinkedIn Posts

Minimum Payout Amounts and Payment Schedules

Understanding minimum payout amounts and payment schedules is crucial for managing your earnings on Shutterstock. These factors determine when and how much money you can withdraw from your account.

Here are some important details:

- Minimum Payout Amount: Shutterstock has a minimum payout threshold, which is typically around $35. You must reach this amount before you can withdraw your earnings.

- Payment Schedule: Payments are processed on a monthly basis. If you reach the minimum payout amount, you can expect to receive your earnings around the middle of the following month.

- Payment Methods: The method you choose (like PayPal or direct deposit) can also influence when you receive your funds. PayPal payments may arrive faster compared to checks.

By keeping track of your sales and understanding these payout details, you can better plan your finances and know when to expect your earnings.

Also Read This: Watching MASN on YouTube TV in 2024

Managing Tax Information for Shutterstock Payments

When you start earning money through Shutterstock, it's important to manage your tax information correctly. Proper handling of your taxes ensures you comply with local regulations and avoid any surprises when tax season arrives.

Here are some key points to consider:

- Tax Information Form: Depending on your location, Shutterstock may require you to fill out a tax information form. This form helps determine if any taxes need to be withheld from your earnings.

- Income Reporting: As a contributor, you are responsible for reporting your earnings to the tax authorities. Keep track of your earnings and any applicable expenses to make this process easier.

- Withholding Taxes: If you live outside the United States, Shutterstock may withhold taxes based on international tax agreements. Make sure to review your tax obligations to avoid unexpected deductions.

It’s wise to consult a tax professional to understand your responsibilities and ensure you're compliant. Managing your tax information effectively will save you time and potential issues down the line.

Also Read This: Celebrate Graduation with Canva Graduation Template

Common Issues with Payments and How to Resolve Them

While Shutterstock strives to provide a smooth payment experience, you may encounter some common issues along the way. Understanding these problems can help you resolve them quickly and ensure you receive your earnings without unnecessary delays.

Here are some frequent payment issues and how to tackle them:

- Delayed Payments: If your payment is delayed, check your account to ensure you’ve reached the minimum payout threshold. Remember, payments are processed monthly, so it may take time before funds appear in your account.

- Incorrect Payment Amount: If you notice that the payment amount is less than expected, review your earnings reports. Make sure your calculations are correct and that you understand any deductions, like taxes.

- Account Setup Issues: Sometimes, payments can be delayed due to incorrect banking information. Double-check your account settings to ensure all details are accurate, especially your bank account or PayPal information.

- Payment Method Confusion: Make sure you know which payment method you’ve selected and its associated timelines. If you switched methods recently, it may take a cycle to process.

If you encounter any issues, reach out to Shutterstock's support team. They can provide guidance and help you resolve any payment-related problems efficiently.

Also Read This: Homemade Air Conditioner Ideas with Easy Tutorials on Dailymotion

Frequently Asked Questions

Many contributors have questions about payments on Shutterstock. Here are some frequently asked questions to help clarify any uncertainties:

- When do I get paid? Payments are typically processed around the 15th of each month, provided you’ve reached the minimum payout threshold.

- What is the minimum payout amount? The minimum payout is usually $35. Make sure your earnings meet this amount before requesting a payment.

- Can I change my payment method? Yes, you can change your payment method in your account settings. Just keep in mind that changes may affect the next payment cycle.

- Will I receive tax documents? Shutterstock will provide tax documents as required by law. Make sure your tax information is up to date to receive these documents.

If you have other questions, don’t hesitate to contact Shutterstock’s support or check their help center for more information.

Conclusion on Shutterstock Payment Process

Understanding the Shutterstock payment process is essential for every contributor. From setting up your payment method to managing your earnings and resolving issues, being informed can make your experience smoother. You now know about various payment options, how earnings are calculated, and how to manage tax information effectively.

As you navigate your journey with Shutterstock, remember to:

- Stay informed about your earnings and payout schedules.

- Regularly check your payment settings for accuracy.

- Reach out for help when needed to resolve any issues quickly.

By staying proactive and informed, you can focus on creating great content while ensuring that your payment experience is hassle-free. Happy creating!