When I began using ShootProof to handle my photography business I didn't give much thought to the tax aspect. To be honest it seemed like just another item on a checklist. However I soon came to understand how vital this step is not only for staying compliant but also for keeping transactions running smoothly. Having tax information in place helps streamline billing and avoids any unwelcome surprises during tax season.

In our lively and thriving economy tax details serve as the unseen link that connects different aspects of your business. They help you collect and report taxes correctly saving you from potential troubles in the future. Consider it a safeguard for your hard earned cash. With this information easily accessible in ShootProof you can concentrate on doing what you enjoy best—capturing precious moments.

Steps to Access Tax Information Settings

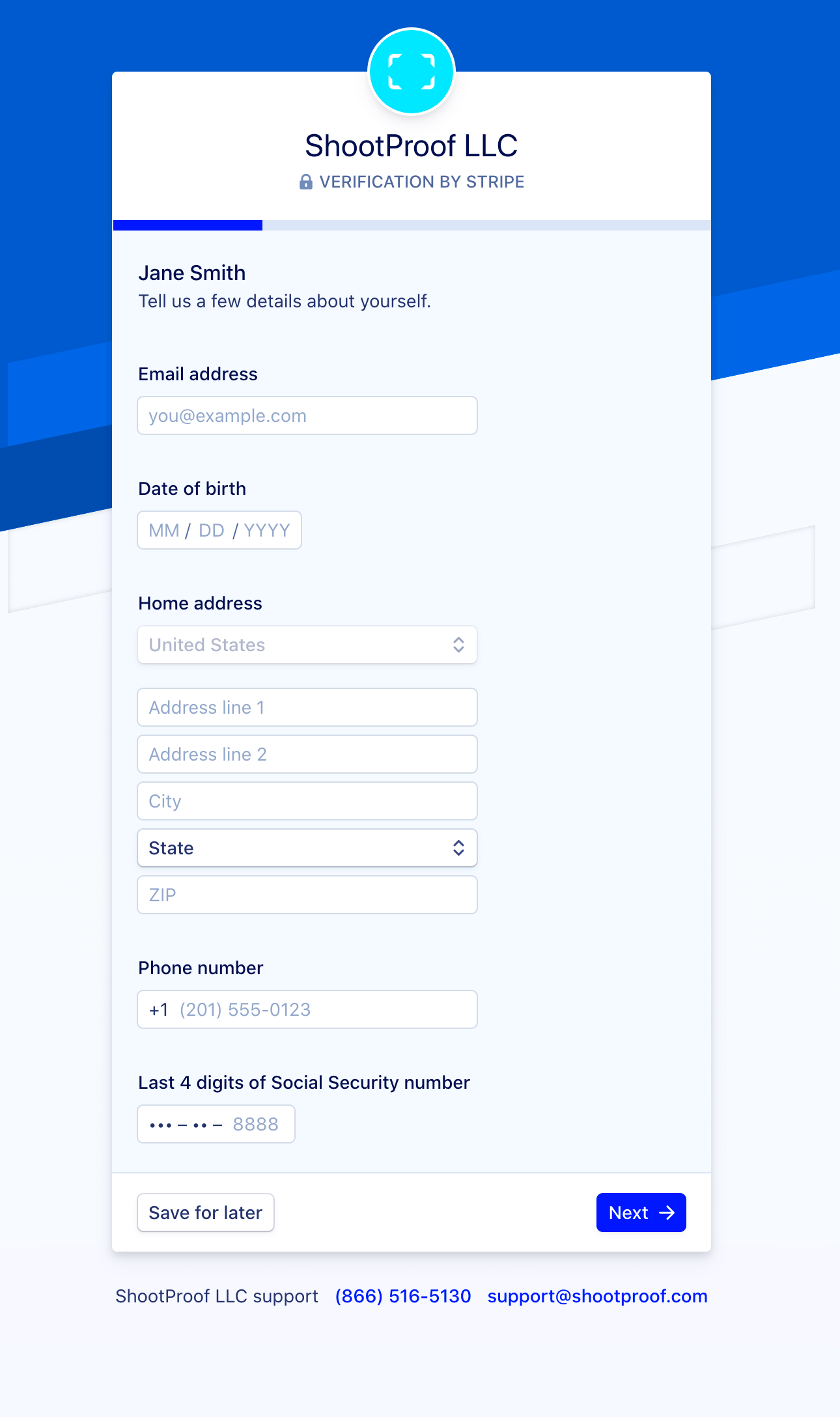

Getting to the tax info settings in ShootProof is simpler than youd expect. Lets walk through it together. When I first explored this feature I was a bit taken aback but it turned out to be pretty easy. Here’s a breakdown of the process.

- Log in to your ShootProof account.

- Navigate to the "Settings" tab, usually found on the left-hand menu.

- Scroll down to find the "Taxes" section.

- Click on "Manage Tax Information."

When you arrive take a moment to get acquainted with the choices at hand. It’s akin to stepping into a room brimming with potential. You’ll come across areas to input tax rates exemptions and other crucial information. Keep in mind that you can modify your tax preferences whenever required so feel free to delve in and make adjustments as necessary.

Also Read This: Achieve 6-Pack Abs at Home with Expert Workouts from Dailymotion

How to Input Your Tax Information

Now that you have gotten into the tax information settings its time to enter your details. It might feel overwhelming at first but believe me its just about being careful and accurate. Here is a guide broken down into steps based on my personal experience.

- Start by selecting your country and state. This ensures that you’re following local tax regulations.

- Next, input your tax rates. For instance, if you're in Mumbai, you might need to include GST. Make sure to double-check the rates as they can change.

- If applicable, add any exemptions for specific clients or services. This can be especially useful for non-profits or schools.

- Finally, review all the information you’ve entered to confirm its accuracy. It’s worth the extra minute to avoid mistakes later.

Wrapping up this task brought a sense of relief. With all my tax details organized I can channel my energy into my creativity instead of stressing over money matters. Its about positioning yourself for achievement investing some time now can pay off handsomely, come tax time.

Also Read This: How to Use Canva Resume Templates to Land Your Dream Job

Tips for Managing Multiple Tax Rates

Handling different tax rates can be a bit like trying to juggle multiple balls at once—its tough but doable. When I started out in photography the tax system appeared to be a tangled web. I soon realized that keeping tabs on tax rates for states or services can be quite challenging. Nevertheless with a few straightforward approaches you can simplify this task.

Here are a few tips that have been incredibly helpful for me.

- Utilize Tax Categories: Categorizing your services helps clarify which tax rate applies. For instance, if you offer portrait sessions and event photography, label each category distinctly to avoid confusion.

- Set Up Automated Calculations: ShootProof allows you to automate tax calculations. This feature saves time and reduces errors. Trust me, it feels great to let technology handle the math!

- Regularly Review Tax Rates: Tax rates can change, so make it a habit to review them quarterly. I like to set reminders on my calendar to keep myself accountable.

- Consult a Tax Professional: When in doubt, reach out to a tax consultant. Their insights can be invaluable, especially for those of us who might feel lost navigating tax regulations.

Dont stress too much about juggling different tax rates. By taking the approach you can stay organized and concentrate on cherishing those special moments.

Also Read This: How Do You Access High-Quality Shutterstock Images for Free Using Downloaders?

Common Mistakes to Avoid When Adding Tax Information

When it comes to entering tax details in ShootProof a tiny mistake can have a big impact. I’ve encountered my share of bumps in the road and those experiences have been valuable. Here are some pitfalls to steer clear of.

- Neglecting to Update Rates: One of the biggest pitfalls is forgetting to update tax rates when they change. I once faced a hefty bill because I hadn’t adjusted my rates. It’s crucial to stay informed!

- Inputting Incorrect Tax Jurisdictions: Ensure you select the correct jurisdiction for your location. Mixing up states or cities can lead to unnecessary complications.

- Overlooking Exemptions: If you offer services to non-profits or schools, don’t forget to apply the appropriate exemptions. Failing to do so might cost you in the long run.

- Ignoring Customer Inquiries: If clients have questions about tax charges, address them promptly. Clear communication builds trust, and misunderstandings can be easily avoided.

By avoiding these pitfalls you can make your tax process smoother and concentrate on what you excel at creating beautiful visuals.

Also Read This: How to Download a Dailymotion Video on Mac

How to Verify Your Tax Information is Correct

Checking your tax details is similar to reviewing the list of ingredients before preparing a meal. Through my own experiences I’ve found that being thorough can prevent you from facing significant issues down the line. Here are a few simple actions you can take to make sure your tax information is correct.

- Review Your Inputs: Go back and carefully review each entry you’ve made. It’s surprising how a simple typo can lead to larger issues.

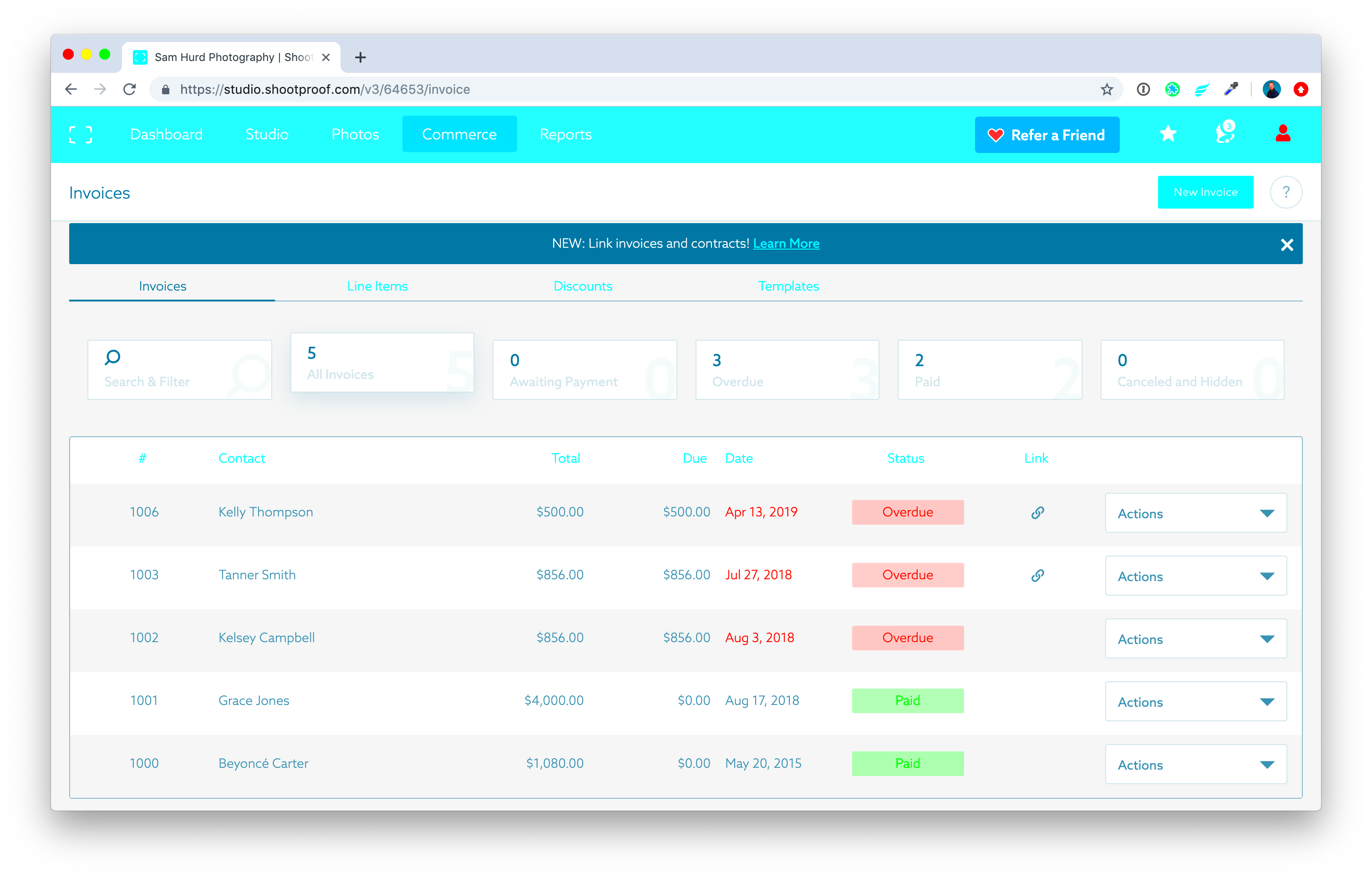

- Run Test Transactions: Create a few mock transactions to see if the tax calculations are working correctly. This practical approach can help you catch errors before they affect your real clients.

- Use Tax Calculation Tools: Utilize online tools or calculators to cross-check the tax rates you’ve entered. It’s always good to have a second opinion!

- Consult Financial Software: If you use accounting software, ensure it aligns with the tax rates set in ShootProof. Discrepancies can lead to confusion later on.

- Keep a Backup of Your Entries: Regularly back up your tax information. This way, if you need to revert to previous data, you can do so without a hitch.

By following these actions you can rest assured that your tax details are correct and current. A bit of carefulness can make a difference in the realm of finance!

Also Read This: The Ultimate Guide to Canceling Your Shutterstock Subscription

Updating Your Tax Information as Needed

While updating your tax information may not be the most thrilling item on your agenda it's crucial for ensuring the smooth operation of your business. I recall the moment I grasped the significance of keeping my tax details up to date. A minor mistake caused some confusion during a hectic wedding season and believe me I wouldn't want you to experience that! As life evolves so do tax rates and regulations. Staying on top of your information can spare you from future hassles.

Here are some helpful suggestions for refreshing your tax details in ShootProof

- Schedule Regular Reviews: Set a reminder every few months to review your tax information. Life can get busy, and it's easy to forget. I’ve found that putting it on my calendar makes it less likely to slip through the cracks.

- Monitor Changes in Tax Laws: Stay informed about local and national tax law changes. There’s always something new happening, and being aware will help you adjust your information accordingly.

- Communicate with Clients: If you’ve changed your rates or tax information, let your clients know. Transparency builds trust, and they’ll appreciate your honesty.

- Use ShootProof’s Features: Take advantage of the tools and features within ShootProof that allow for easy updates. The platform is designed to be user-friendly, making it simple to modify your information when necessary.

When you keep your tax information up to date you'll have more time to concentrate on what really counts—making wonderful memories for your clients.

Also Read This: Where to Watch A Christmas Spark Full Movie on YouTube

FAQs About Adding Tax Information in ShootProof

While exploring ShootProof I found myself wondering about tax matters. It turns out that many other photographers had the same questions. Here are some common queries that I think will help clarify any uncertainties you might have:

- How do I find my local tax rates? Most local government websites provide updated tax rate information. You can also consult with a tax professional to ensure you're using the correct figures.

- Can I set different tax rates for different services? Yes, ShootProof allows you to set different tax rates based on the services you offer. This flexibility is a lifesaver!

- What if I make a mistake in my tax settings? Don’t worry! You can easily edit your tax settings at any time. Just navigate back to the “Taxes” section in your ShootProof account.

- How can I handle tax exemptions? If you work with non-profit organizations or offer special rates, you can apply exemptions directly in the tax settings. Just be sure to document everything.

- Is it necessary to consult a tax professional? While it’s not mandatory, consulting a tax professional can be incredibly beneficial, especially if you’re unsure about specific regulations or rates.

These frequently asked questions are here to clarify the process and simplify how you handle your tax details!

Wrapping Up and Best Practices for Tax Management

In conclusion I want to stress how crucial it is to handle your taxes well in your photography venture. During my experiences I’ve discovered that staying ahead with tax matters not makes things easier but also brings you a sense of calm. Imagine how much more you can focus on your clients when you’re not worrying about tax problems!

Here are a few strategies that have proven effective for me.

- Stay Organized: Keep all tax documents, rates, and client records organized in one place. I use digital folders to ensure everything is easily accessible.

- Keep Learning: Tax laws and regulations can change. Take time to educate yourself through workshops or online courses. Knowledge is power!

- Document Everything: Always keep a record of your tax settings, changes made, and communications with clients regarding taxes. This documentation can be invaluable during audits.

- Use Technology: Leverage tools like ShootProof to streamline your tax management process. Automating calculations and updates can save you precious time.

- Build a Support Network: Connect with fellow photographers or join online communities where you can share experiences and advice. Sometimes, just knowing you’re not alone makes all the difference!

By adhering to these guidelines you'll be on the path to becoming proficient in handling taxes for your photography venture. Cheers to seizing lovely moments without the burden of tax concerns!