Automated Teller Machines, or ATMs, have revolutionized banking by providing convenient access to cash and banking services. For beginners, using an ATM might seem a bit daunting, but it’s actually quite simple and user-friendly. Imagine being able to withdraw cash, check your balance, or even transfer funds—all without stepping into a bank! In this guide, we will walk you through the basics of using an ATM, ensuring you feel confident and comfortable each time you use one.

Understanding ATM Functions

ATMs are more than just cash dispensers; they offer a variety of functions that cater to different banking needs. Let’s break down some of the most common functionalities:

- Cash Withdrawal: This is the primary function of an ATM. You can withdraw cash in various denominations, depending on your bank's limits.

- Balance Inquiry: Want to know how much money you have? Simply select the balance inquiry option, and the ATM will display your current account balance.

- Deposit Services: Some ATMs allow you to deposit cash or checks directly. Just follow the prompts to ensure your funds are safely credited to your account.

- Account Transfers: Need to move money between different accounts? Many ATMs offer a transfer function, making it easy to manage your finances.

- Mini Statements: You can often print a mini statement that shows your recent transactions, helping you keep track of your spending.

In addition to these functions, ATMs are equipped with features designed for user convenience, such as:

| Feature | Description |

|---|---|

| Touchscreen Interface | Most modern ATMs use touchscreens for easy navigation through various options. |

| Language Selection | You can usually choose your preferred language to make the process smoother. |

| Card Reader | The card reader securely processes your debit or credit card for transactions. |

Understanding these functions will help you maximize your ATM experience, ensuring you can handle your banking needs swiftly and confidently!

Also Read This: The Rise of TikTok: Tips for Brands to Succeed on the Platform

3. Preparing to Use an ATM

Getting ready to use an ATM might seem straightforward, but a little preparation can make your experience smooth and hassle-free. Here’s a quick checklist to help you gear up:

- Check Your Card: Ensure you have your ATM or debit card handy. Look for any damage on the card, like scratches or bends, which might prevent it from being read.

- Know Your PIN: Before heading to the ATM, make sure you remember your Personal Identification Number (PIN). If you've forgotten it, you might need to visit your bank for a reset.

- Choose a Safe Location: Select an ATM in a well-lit, secure area, preferably at your bank or a busy location. This helps ensure your safety while you withdraw or deposit cash.

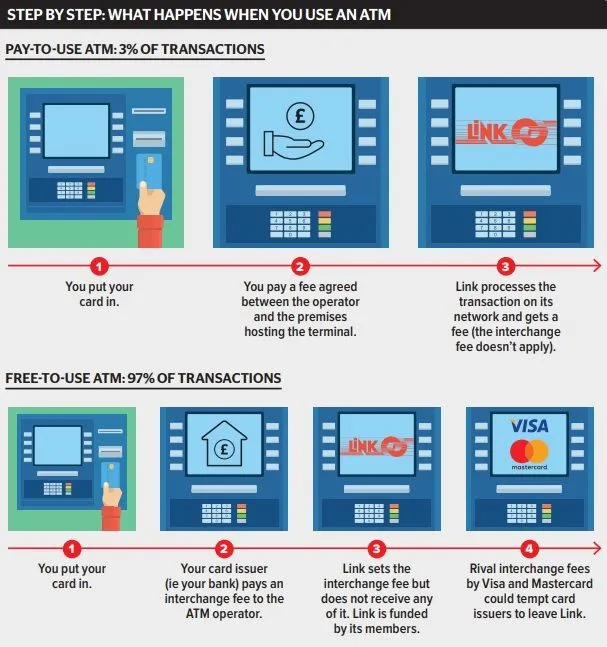

- Be Aware of Fees: If you’re using an ATM outside your bank’s network, check the fee structure. Many banks display this information on or near the machine.

- Have Your Needs in Mind: Decide beforehand how much cash you need. This can prevent multiple transactions, saving you time and reducing withdrawal fees.

With these preparations, you’re set to approach the ATM with confidence!

Also Read This: Font Awesome vs. Flaticon: A Comparative Analysis

4. Step-by-Step Guide to Using an ATM

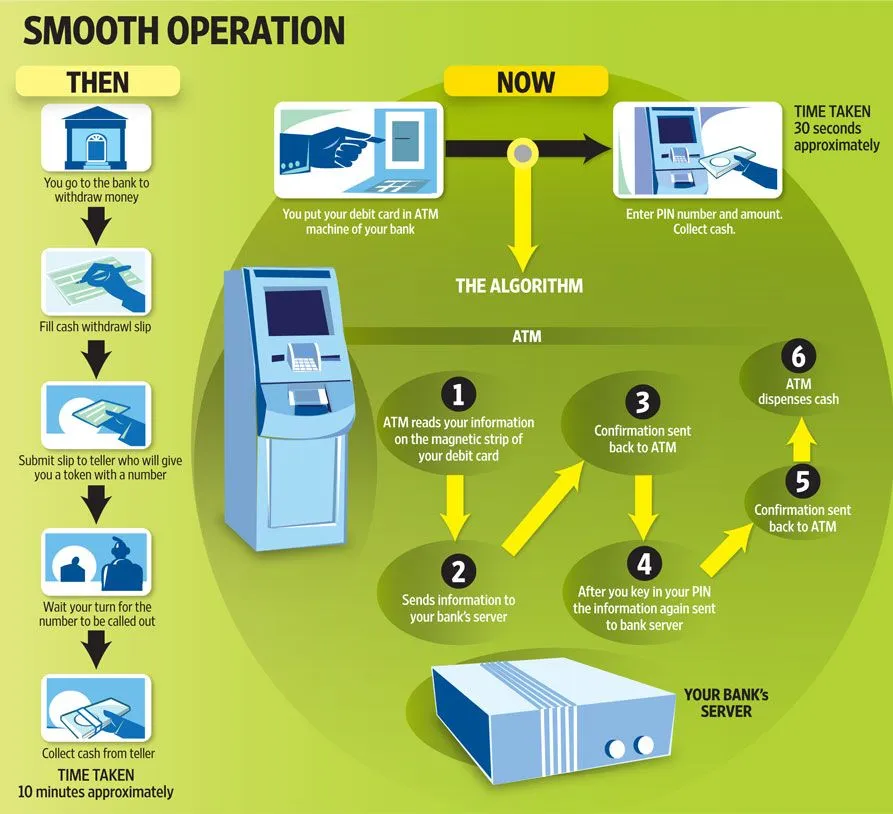

Using an ATM is a straightforward process, but it can be intimidating for beginners. Follow this step-by-step guide to navigate the machine like a pro:

- Insert Your Card: Place your card into the machine, ensuring the chip or magnetic strip faces the correct direction.

- Enter Your PIN: Once prompted, type in your PIN using the keypad. Be discreet while doing this to protect your information.

- Select Your Transaction: Choose the type of transaction you want to perform. Options typically include:

- Cash Withdrawal

- Balance Inquiry

- Deposit

- Transfer Funds

And just like that, you’ve successfully used an ATM! With practice, it becomes second nature.

Also Read This: Unlocking Todoroki in My Hero Ultra Rumble

Common ATM Transactions

Using an ATM can seem a bit daunting at first, but once you know the ropes, it’s a breeze! Let’s break down some of the most common transactions you can perform at an ATM:

- Cash Withdrawal: This is the most popular function. Simply insert your card, enter your PIN, select the amount, and voilà! Cash is dispensed.

- Balance Inquiry: Want to know how much money you have? Just choose the balance inquiry option to view your account balance on the screen.

- Deposit: Many ATMs allow you to deposit checks or cash. Just select the deposit option, follow the prompts, and confirm your transaction.

- Transfer Funds: Need to move money between accounts? Some ATMs let you transfer funds quickly and efficiently. Just select the transfer option and enter the required details.

- Print Mini-Statement: Some ATMs offer a quick view of your last few transactions. This is great for keeping track of your spending.

These functions can vary by ATM, so it’s always good to look for on-screen instructions. Familiarizing yourself with these common transactions will make your banking experience much smoother!

Also Read This: Understanding Rumble Boxing Costs and Membership Options

Troubleshooting ATM Issues

Even the most user-friendly ATMs can sometimes throw a curveball. Here are some common issues you might encounter and how to troubleshoot them:

| Issue | Possible Solutions |

|---|---|

| ATM Doesn't Dispense Cash |

|

| Card Stuck in ATM |

|

| Unable to Complete Transaction |

|

Remember, if you run into any persistent issues, don’t hesitate to reach out to your bank’s customer support for help. They’re there to assist you!

Also Read This: Integrating LinkedIn with Your Outlook Account

7. Tips for Safe ATM Usage

Using an ATM can be convenient, but it’s essential to prioritize your safety. Here are some practical tips to ensure a secure experience:

- Choose Wisely: Always select ATMs in well-lit, busy areas. Avoid isolated locations, especially at night.

- Stay Aware of Your Surroundings: Before you approach an ATM, scan the area. If something feels off, it’s okay to leave and find another machine.

- Use ATMs Affiliated with Your Bank: Whenever possible, use ATMs that belong to your bank. These are often more secure and may have lower fees.

- Cover Your Pin: Always shield your PIN when entering it. Use your other hand or your body to block anyone from seeing.

- Be Cautious of Skimmers: Check for any unusual devices attached to the ATM’s card slot or keyboard. If it looks suspicious, don’t use it.

- Keep Your Transactions Quick: Don’t linger at the ATM. Complete your transaction swiftly and be aware of anyone waiting behind you.

- Check Your Account Regularly: Monitor your bank statements and account activity to catch any unauthorized transactions early.

By following these tips, you can enjoy a safer ATM experience and minimize risks associated with cash withdrawals.

8. Conclusion

Using an ATM machine can be a straightforward process, especially with a little knowledge and preparation. Whether you're withdrawing cash for groceries, checking your balance, or depositing money, understanding the steps involved can help you feel more confident.

Remember, safety should always be your priority. By choosing ATMs wisely, being aware of your surroundings, and taking precautions against fraud, you can make your ATM experience secure and stress-free. Always keep learning and stay updated on any new features or safety measures your bank may provide.

So, the next time you need to use an ATM, just remember these tips, and you’ll be good to go! Happy banking!