Running a photography business often makes me ponder the different ways to ensure a seamless and enjoyable experience for my clients. One crucial element that tends to be overlooked is the payment process. Picture a client filled with anticipation for their photos only to be held up by a cumbersome payment procedure. This can put a damper on their overall experience and in some instances even discourage them from coming back. At ShootProof providing payment options is not just a nice to have but an essential requirement. It demonstrates how much you prioritize your clients convenience and time.

In todays world customers value flexibility and relying on just one payment method can be restrictive. By offering options you not only reach a broader audience but also build trust with your clients. They appreciate having a say in their choices. A smooth payment process can boost client satisfaction leading to positive feedback and recommendations. Consider this when clients have a range of options available they feel more empowered. And when they feel empowered they are inclined to share their enjoyable experiences with friends and family. This ultimately benefits your business making it advantageous to introduce multiple payment methods.

Exploring Different Payment Methods Available

In today's world there are plenty of ways for customers to make payments. Each method comes with its own set of benefits and knowing these can assist you in choosing what to provide in ShootProof. Lets take a look at a few options.

- Credit and Debit Cards: These are the most common forms of payment. They’re quick, convenient, and familiar to most clients.

- PayPal: Known for its security, PayPal allows users to make payments without sharing credit card information, which can be a major plus for privacy-conscious clients.

- Apple Pay and Google Pay: These mobile payment methods are gaining popularity for their speed and ease of use. Clients appreciate being able to pay with just a tap of their phones.

- Bank Transfers: While not as immediate, bank transfers can be a reliable option for clients who prefer traditional methods.

From what Ive seen offering a variety of payment options can really boost clients confidence. For example in a shoot one client chose PayPal for security while another went with their credit card for convenience. This mix of payment methods made both clients feel at ease and happy with the process.

Also Read This: What Are the Top Tips for Navigating Adobe Stock’s Library for Budget-Friendly Assets?

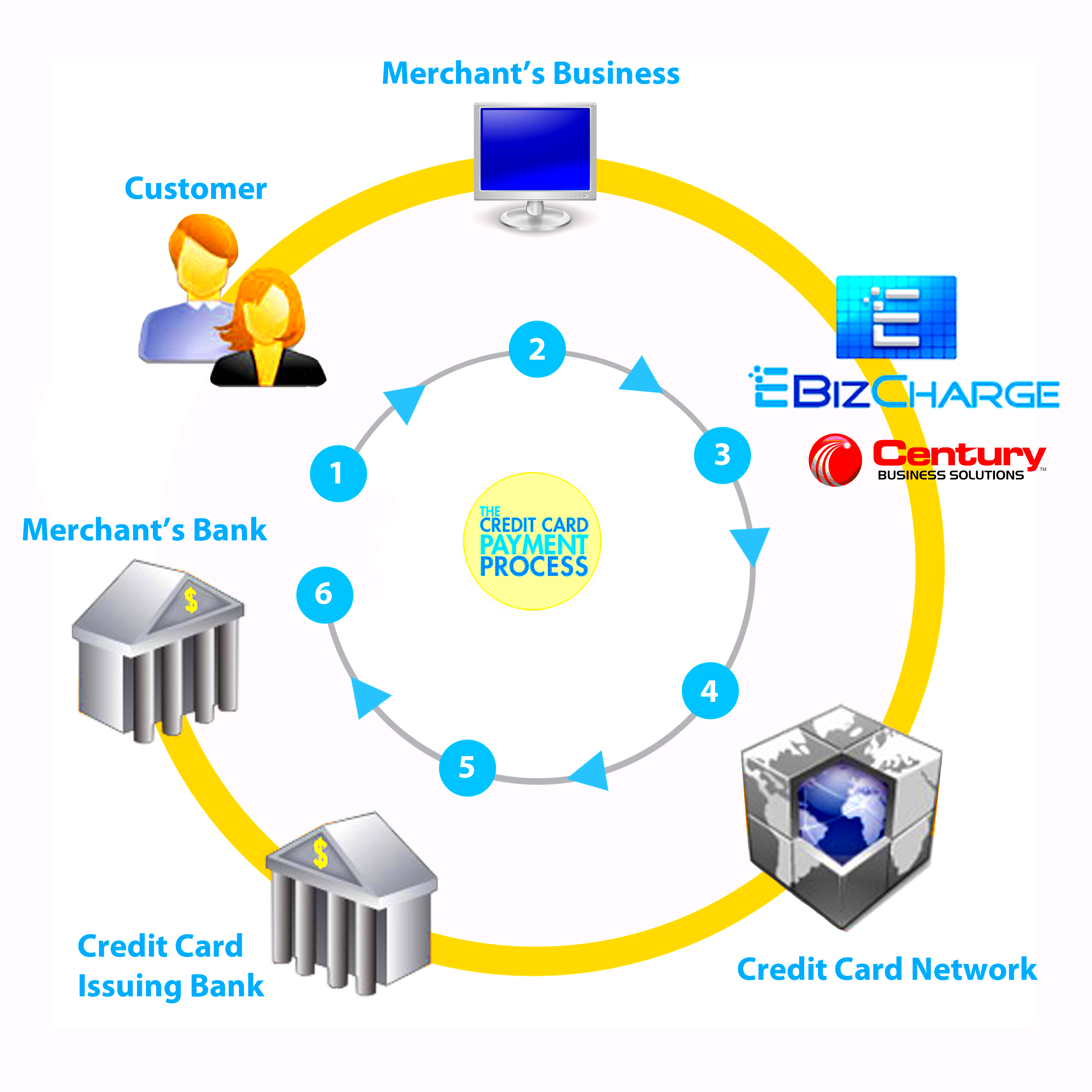

How to Integrate Credit Card Payments Seamlessly

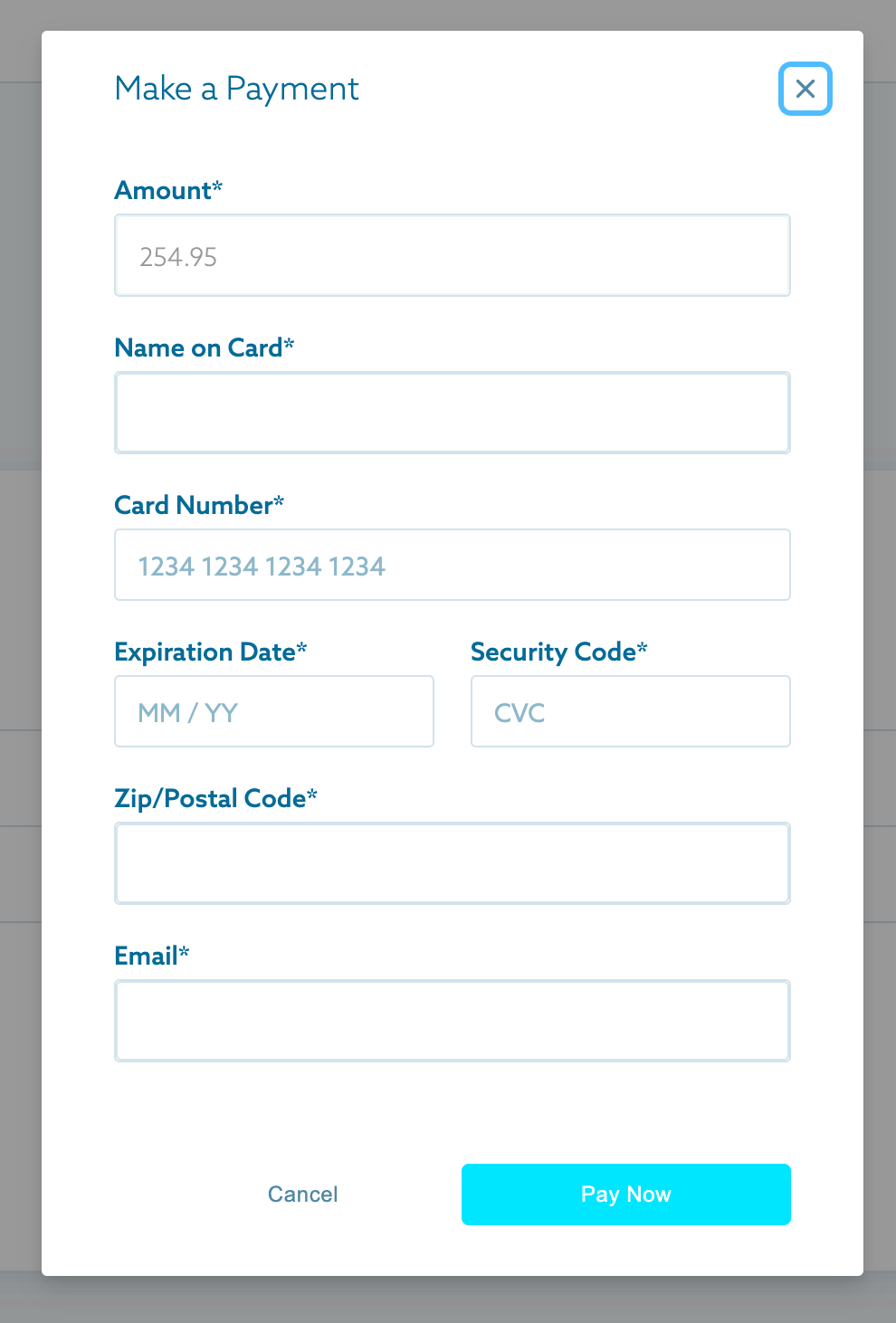

Adding credit card payments to your ShootProof system isnt as challenging as it may seem. By following a few simple steps you can make the process seamless for both yourself and your clients. Here's a guide on how to do it.

- Choose a Payment Processor: Select a reliable payment processor that supports credit card payments. Popular options include Stripe, Square, and PayPal. Each has its own set of features, so choose one that aligns with your business needs.

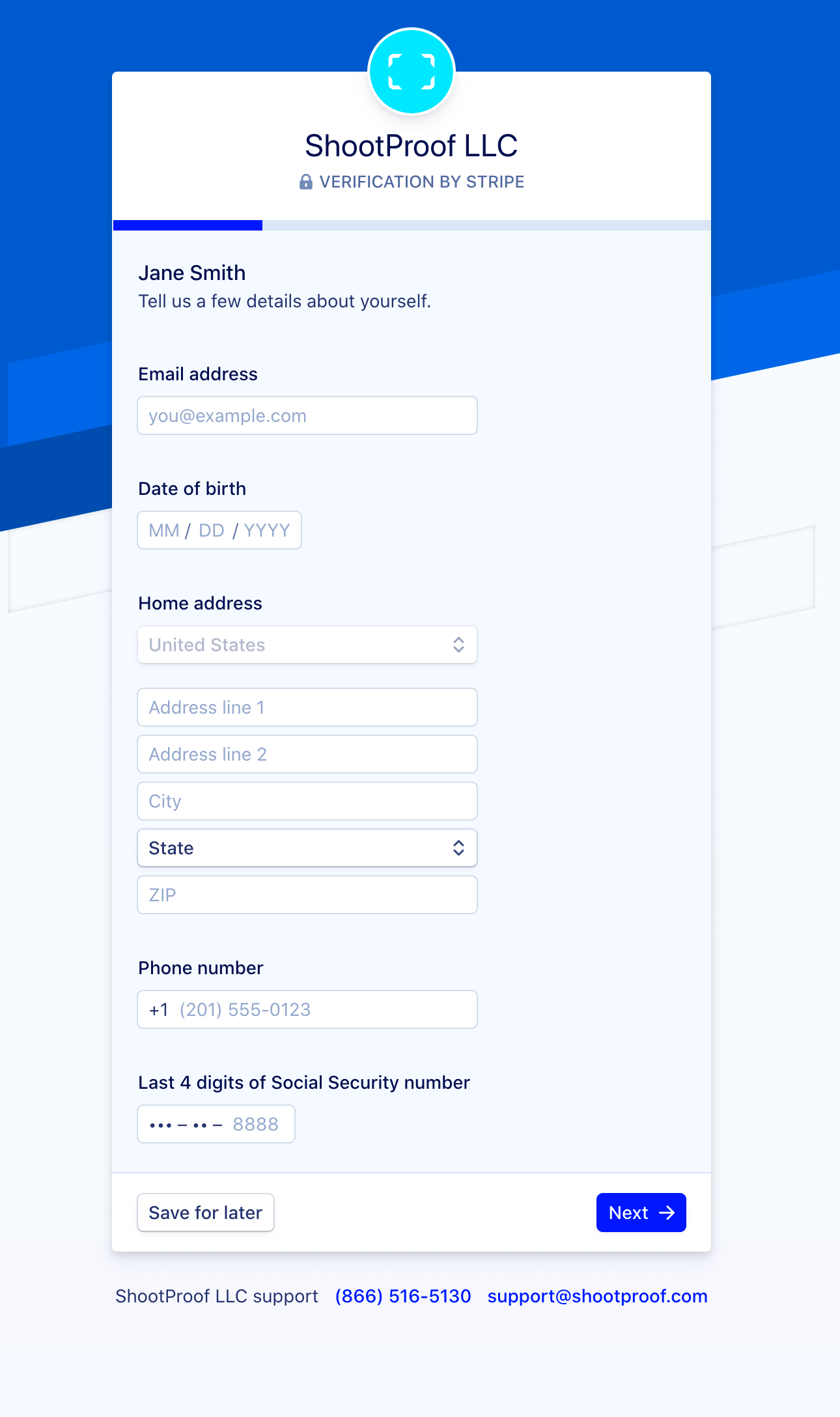

- Set Up Your Account: Once you’ve chosen a payment processor, create an account and follow their specific instructions for integration. This typically involves linking your bank account to receive funds.

- Integrate with ShootProof: ShootProof offers straightforward integration with various payment processors. Navigate to the payment settings in your account and follow the prompts to connect your chosen processor.

- Test the Payment Process: Before going live, do a few test transactions to ensure everything works as expected. This is crucial to identify any hiccups before your clients do.

Having dealt with payment integrations in the past I can vouch for how much easier it is when everything goes smoothly. There was a time when I lost a client due to a convoluted payment setup. That experience taught me the importance of prioritizing seamless integrations that ultimately benefit my business. The simpler you make it for clients to pay the more inclined they will be to choose your services once more.

Also Read This: Uploading PDF to Behance

Ensuring Security for Online Transactions

To make sure your clients feel secure think about putting these security precautions in place

- SSL Certification: Secure Sockets Layer (SSL) certification encrypts data between your website and the user’s browser, making it difficult for anyone to intercept sensitive information.

- Two-Factor Authentication: Adding an extra layer of security by requiring a second form of verification helps protect your accounts from unauthorized access.

- Secure Payment Processors: Use trusted payment processors that comply with Payment Card Industry Data Security Standards (PCI DSS). This guarantees that they adhere to the highest security standards.

- Regular Security Audits: Conducting periodic security audits can help identify potential vulnerabilities in your payment system before they become problematic.

Implementing these security measures not only puts your clients at ease but also lets you concentrate on your craft without constantly fretting about safety concerns. I can genuinely say that since adopting these protocols my clients confidence in my services has grown considerably. It was reassuring to know that they could rely on me which is crucial, for nurturing enduring partnerships.

Also Read This: Effortless File Transfer of Adobe Stock Images to Your Projects

Enhancing User Experience with Multiple Payment Choices

Have you ever found yourself wanting to make a purchase only to be put off by the limited payment options available? I certainly have and it was quite frustrating. In the world of photography a seamless user experience often depends on the convenience of payment methods for clients. Providing a range of payment options can significantly improve this experience making clients feel at ease and content with their transaction.

Here are a few strategies to improve the user experience by offering payment choices.

- Diverse Options: By integrating various payment methods—credit cards, digital wallets, and bank transfers—you cater to a broader audience. Each client has their own preference, and accommodating these can lead to higher conversion rates.

- Mobile-Friendly Interface: With an increasing number of clients using smartphones, ensuring your payment interface is mobile-friendly can significantly improve the user experience.

- Simplified Checkout Process: A complicated checkout can lead to cart abandonment. Keep the process as straightforward as possible—fewer clicks often mean more completed transactions.

- Transparent Fees: Clearly display any fees associated with payment methods to avoid surprises. Transparency builds trust and helps maintain a good relationship with your clients.

By prioritizing user experience I have witnessed a significant boost in customer satisfaction. I recall a client expressing their gratitude for the option to pay using their preferred method as it added a touch to the process and made it feel more customized to their preferences. This gesture of providing choices can greatly contribute to building brand loyalty.

Also Read This: How to Logout of Telegram Properly

Common Challenges and Solutions for Adding Payment Options

Introducing payment options like any endeavor has its set of hurdles. I remember when I attempted to expand my payment methods it seemed like a challenging undertaking. Nevertheless every obstacle brought with it a chance for development and enhancement. Being ready to tackle these challenges can ease the transition and ultimately bring advantages to your business.

Here are a few obstacles people often face along with some helpful ways to overcome them.

- Integration Issues: Sometimes, payment processors don’t integrate smoothly with your existing systems. Solution: Choose payment processors known for their compatibility and ease of integration with platforms like ShootProof.

- Increased Transaction Fees: Different payment methods come with varying fees. Solution: Evaluate your options carefully. Some processors offer competitive rates that can save you money in the long run.

- Client Confusion: Too many options can overwhelm clients. Solution: Provide clear instructions and guidance during the payment process. A simple FAQ section can help address common concerns.

- Maintaining Security: With multiple payment methods, ensuring security becomes more complex. Solution: Regularly update your security protocols and stay informed about best practices in online payment security.

Looking back on my path I’ve come to see that every obstacle I encountered brought me important insights. The trick is to take action instead of just responding to situations. Getting through these difficulties not only improved how I run my business but also gave me a clearer understanding of what my clients want. By addressing these challenges directly we can build a payment system that is stronger and more user friendly for customers.

Also Read This: Effective Strategies for Removing iStock Watermarks from Videos

Tips for Encouraging Clients to Use Credit Card Payments

Convincing clients to adopt card payments can be a bit tricky at times but with the approach it can seamlessly integrate into your business. I recall the moment I introduced card payments in my photography venture I felt anxious about my clients reactions. However to my surprise many found the convenience appealing. Here are some tips that have proven effective for me in encouraging clients to choose card payments.

- Highlight Convenience: Make it clear how easy and quick credit card payments can be. Share stories of clients who loved the speed of transactions during events or shoots.

- Offer Promotions: Consider running a special promotion, such as a discount for using credit card payments. A little incentive can motivate clients to choose this option.

- Provide Clear Instructions: Sometimes, clients are hesitant simply because they’re unsure about the process. Providing clear and simple instructions can alleviate any doubts.

- Share Testimonials: If you have previous clients who had a positive experience with credit card payments, sharing their testimonials can help build trust. A personal touch can go a long way.

- Assure Security: Let your clients know about the security measures you have in place for online payments. Sharing your SSL certification or payment processor's reputation can give them peace of mind.

Based on what Ive seen when clients experience the convenience and safety of using cards they tend to prefer this payment option. Its really about ensuring that they feel at ease and appreciated.

Also Read This: Discover the Best Golgappa Recipes on Dailymotion Videos

Frequently Asked Questions about Credit Card Payments in ShootProof

With the increasing number of photographers incorporating card payments into their ShootProof accounts its normal for clients to have inquiries. I’ve discovered that tackling these questions head on can alleviate concerns and foster confidence. Below are some commonly asked questions along with my responses that I frequently come across.

| Question | Answer |

|---|---|

| Is it safe to use my credit card on ShootProof? | Absolutely! ShootProof uses SSL encryption and partners with trusted payment processors to ensure your information is secure. |

| What payment methods are accepted? | ShootProof supports a variety of credit cards, along with digital payment options like PayPal, making it convenient for everyone. |

| Will I receive a receipt after payment? | Yes, you will receive an automatic email receipt confirming your payment as soon as the transaction is processed. |

| What if there’s an issue with my payment? | If you encounter any problems, feel free to reach out to the support team at ShootProof, and they’ll assist you promptly. |

By addressing these inquiries you can greatly alleviate the concerns of your clients. Speaking from experience I have noticed that offering detailed responses in advance is well received by clients as it fosters trust and increases the likelihood of them proceeding with their payments smoothly.

Wrapping Up: The Benefits of Adding Credit Card Payment Options

Looking back on my path as a photographer I can confidently say that introducing credit card payment options has revolutionized my business. At first I was reluctant concerned about the possible challenges. Nevertheless I quickly came to understand that this decision unlocked opportunities for expansion and enhanced client contentment. Providing credit card payment options brings advantages that can greatly benefit your venture.

- Improved Cash Flow: Credit card payments ensure quicker access to funds, which can help manage your business expenses more effectively.

- Enhanced Customer Satisfaction: Clients appreciate the convenience of credit card payments, leading to a better overall experience.

- Increased Sales: The easier you make the payment process, the more likely clients are to complete their purchases. A smooth transaction can often lead to higher sales.

- Client Trust: By offering secure payment options, you foster a sense of trust and reliability, making clients more likely to return.

From my perspective ever since I started accepting card payments I’ve noticed a boost in both income and returning customers. It’s a tweak that has brought about advantages. If you’re hesitating about introducing credit card payment methods I urge you to go for it. Your customers and your venture will appreciate it!