Budgeting is a vital skill that everyone should develop. It helps you manage your money wisely and plan for the future. Without a budget, it’s easy to lose track of your spending, which can lead to financial stress. By knowing how much money you have coming in and going out, you can make informed decisions about your finances.

Here are some reasons why budgeting is essential:

- Control Over Finances: A budget gives you control over your spending habits.

- Identify Spending Patterns: Tracking your expenses helps you see where your money goes.

- Achieve Financial Goals: Whether saving for a vacation or a new car, a budget can help you reach those goals faster.

- Reduce Financial Stress: Knowing you have a plan in place can ease anxiety about money.

Explore the Features of Canva Budget Template

Canva's Budget Template is designed to make budgeting easy and visually appealing. It provides a structured way to track your income and expenses. Here’s what makes it stand out:

- User-Friendly Interface: Canva is easy to navigate, even for beginners.

- Customizable Design: You can change colors, fonts, and layouts to suit your style.

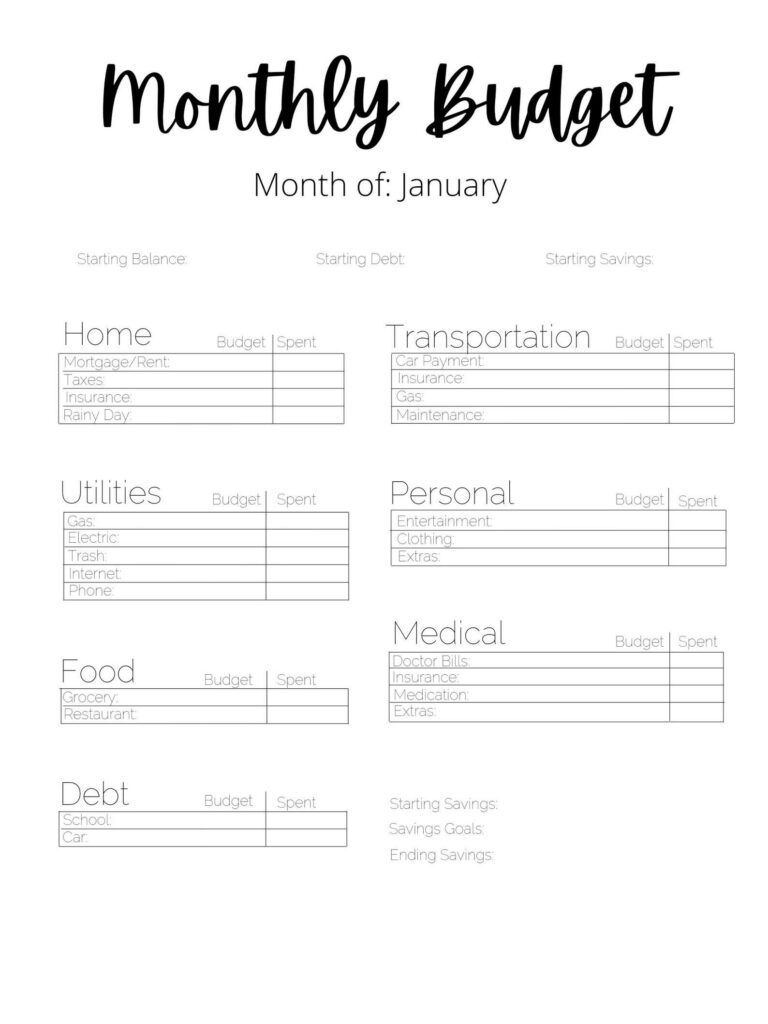

- Pre-Made Sections: The template includes sections for income, expenses, and savings, making it simple to fill out.

- Graphical Representations: Visual aids, like pie charts and bar graphs, help you understand your budget at a glance.

- Accessible Anywhere: Since Canva is cloud-based, you can access your budget from any device.

Also Read This: Why Teens Are Embracing LinkedIn for Career Growth and Networking

Learn How to Access the Canva Budget Template

Getting started with Canva's Budget Template is straightforward. Follow these simple steps:

- Visit Canva: Go to the Canva website or open the app.

- Create an Account: If you don’t have an account, sign up for free.

- Search for Templates: Use the search bar and type “Budget Template.”

- Select a Template: Browse through the options and pick a design that fits your needs.

- Edit Your Template: Click on the template to open it, and start customizing it with your information.

- Save Your Work: Don’t forget to save your budget for future reference.

Once you have your budget set up, you’ll be on your way to better financial management!

Also Read This: Exploring the Submission Criteria: Does Alamy Accept AI-Generated Images?

Customize Your Budget Template for Your Needs

Customizing your budget template is key to making it work for you. A one-size-fits-all approach often falls short, as everyone has unique financial situations and goals. Thankfully, Canva makes it easy to personalize your budget template so it truly reflects your needs.

Here are some ways to tailor your budget template:

- Add Income Sources: Include all your income sources, such as salary, side gigs, and any passive income. This gives you a complete picture of your finances.

- Break Down Expenses: Divide your expenses into categories like housing, groceries, entertainment, and savings. This helps you see where you can cut back.

- Set Savings Goals: Create a section for your savings goals, whether it’s an emergency fund or a vacation. This keeps you motivated.

- Use Color Coding: Color coding different sections makes your budget visually appealing and easier to read. You can assign colors to various categories to help differentiate them at a glance.

- Include Notes: Use the notes section to jot down any reminders or thoughts related to your budget. This could be tips for the next month or reminders for upcoming bills.

By customizing your budget template, you’ll create a tool that not only helps you track your money but also motivates you to reach your financial goals!

Also Read This: How Much Gamers Earn on YouTube and Insights into Gaming Channel Revenue

Tips for Effectively Using Your Budget Template

Using your budget template effectively is essential to make the most of your financial planning. Here are some practical tips to help you stay on track:

- Update Regularly: Make it a habit to update your budget weekly or monthly. This keeps your information current and helps you spot trends.

- Be Realistic: Set realistic spending limits that you can stick to. Overly strict budgets can lead to frustration and give you the urge to abandon your plan.

- Track All Expenses: Don’t skip small purchases. Every dollar counts, and tracking all your expenses gives you a full picture of your spending habits.

- Review and Adjust: Regularly review your budget to see what’s working and what’s not. Adjust your categories or limits as your financial situation changes.

- Use the Budget for Planning: Look ahead and plan for upcoming expenses, such as holidays or vacations. This helps you allocate your funds better and avoid surprises.

These tips will not only help you stay organized but also empower you to make informed decisions about your finances!

Also Read This: Imago Images as the Perfect Choice for Your Digital Advertising Campaigns

Common Mistakes to Avoid When Budgeting

Budgeting can be a great tool for managing your finances, but there are some common pitfalls that can undermine your efforts. Here are mistakes to watch out for:

- Not Being Specific: Vague categories like "miscellaneous" make it hard to see where your money is going. Be specific about your spending.

- Failing to Plan for Irregular Expenses: Don’t forget to include expenses that don’t happen monthly, like car maintenance or annual subscriptions.

- Ignoring Small Expenses: Small purchases can add up quickly. Make sure to track even minor expenses to get a complete picture.

- Setting Unrealistic Goals: Avoid setting unattainable savings goals. Start small and build up to bigger targets as you get comfortable.

- Not Reviewing Your Budget: Failing to review and update your budget regularly can lead to overspending. Make it a routine to check your budget.

By avoiding these mistakes, you'll have a smoother budgeting experience, helping you achieve your financial goals more effectively!

Also Read This: Charges for Photos on Shutterstock

Check Out Real-Life Examples of Budget Templates

Sometimes, seeing is believing! Real-life examples of budget templates can inspire you and show you how to make the most of your budgeting journey. Whether you’re a student, a parent, or a professional, there are templates tailored for every need.

Here are some popular real-life budget templates you might find helpful:

- Personal Monthly Budget: This template tracks your income and expenses over the month, helping you understand your spending habits.

- Family Budget Planner: Designed for families, this template helps manage household expenses, childcare costs, and family outings.

- Student Budget Template: Perfect for students, this template considers tuition, textbooks, and living expenses to help manage finances during school.

- Event Budget Template: If you’re planning a wedding or party, this template helps you track costs for venues, catering, and entertainment.

- Travel Budget Template: Plan your trips by estimating travel costs, accommodation, food, and activities, ensuring you stick to your budget while having fun.

By checking out these real-life examples, you can find a template that fits your needs and motivates you to take charge of your finances. Canva offers a variety of templates that you can customize, making budgeting a more enjoyable experience!

Also Read This: Choosing Authentic Photos for Genuine Campaigns on Imago Images

Frequently Asked Questions About Canva Budget Template

Got questions about the Canva Budget Template? You’re not alone! Here are some of the most common questions people have:

- Is Canva Budget Template free to use? Yes, Canva offers many free templates, including budget templates, that you can customize without any cost.

- Can I download my budget template? Absolutely! After customizing your budget template, you can download it as a PDF, PNG, or even print it directly.

- Are there tutorials available for using Canva? Yes, Canva provides tutorials and guides to help you get the most out of their platform.

- Can I collaborate with others on my budget template? Yes, Canva allows you to share your design with others, making it easy to collaborate on budgets with family or friends.

- What if I need more features? Canva offers a Pro version with additional features, including more templates and design elements, for those who want extra functionality.

These FAQs should help clear up any doubts you may have about using the Canva Budget Template. Remember, the goal is to make budgeting easy and enjoyable!

Wrap Up Your Budgeting Journey with Canva

Congratulations on taking the steps to manage your budget with Canva! Budgeting doesn’t have to be boring or stressful. With the right tools and mindset, you can turn it into a rewarding experience.

As you wrap up your budgeting journey, here are a few final thoughts:

- Stay Consistent: Regularly update and review your budget to stay on track.

- Celebrate Small Wins: Every time you meet a savings goal or reduce expenses, take a moment to celebrate!

- Adjust When Necessary: Life changes, and so should your budget. Don't hesitate to make adjustments as your financial situation evolves.

- Keep Learning: Financial literacy is a journey. Continuously seek knowledge on budgeting and money management.

By utilizing the Canva Budget Template and following these tips, you’re well on your way to achieving your financial goals. Happy budgeting, and may your finances thrive!