Credit card processing fees can sometimes catch business owners off guard, particularly photographers. I recall when I began my photography adventure I was so engrossed in capturing moments that I neglected to pay attention to the intricacies of payment processing. These fees though essential can accumulate and affect your profit margins. It's important to grasp what these fees entail and how they function.

Essentially a fee for processing credit card payments is an expense that merchants incur when a payment processor manages their transactions. This fee typically consists of components, namely a percentage of the sale and a fixed charge for each transaction. The specific amount of these fees can vary widely based on the processor and the card type used. If you're a photographer you may be curious about how to navigate this financial terrain without driving yourself crazy.

Some key points to consider include:

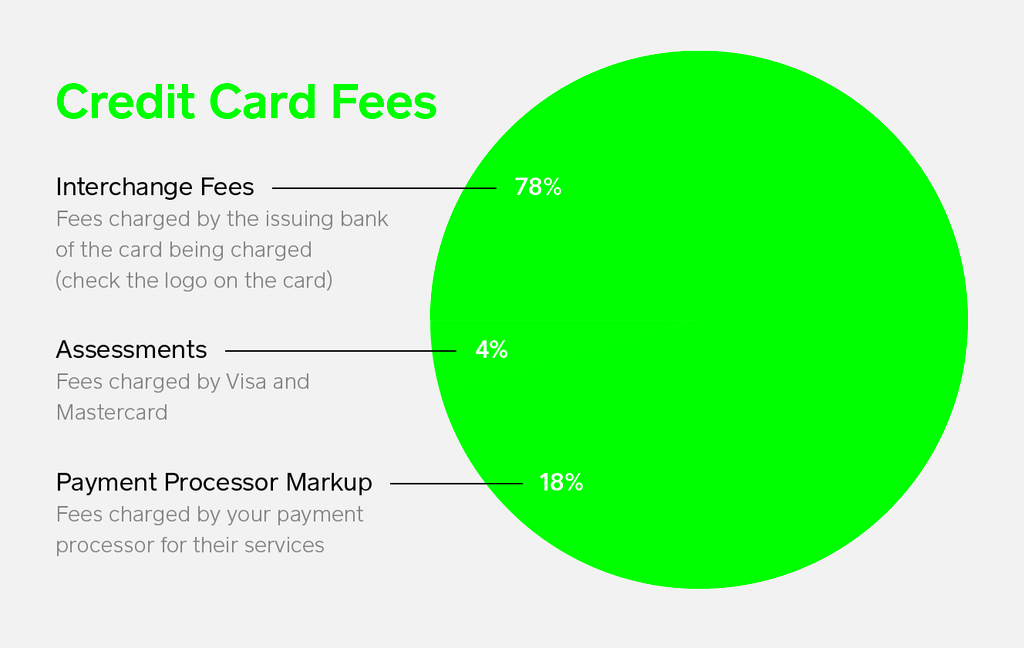

- Transaction Fees: These are typically charged as a percentage of the sale plus a fixed fee.

- Interchange Fees: These are fees set by the credit card networks, which go to the bank that issued the card.

- Service Fees: Your payment processor might have additional service fees for using their platform.

How ShootProof Handles Payment Transactions

ShootProof is an amazing tool for photographers but how do they handle payment transactions? When I joined I was really impressed by the simplicity of the process. Their payment system is tailored to cater to photographers allowing you to concentrate on your craft without getting caught up in the nitty gritty of financial matters.

When a customer buys something from your ShootProof gallery the payment is handled securely. ShootProof works with trusted payment processors to keep your clients information protected. Let me break down the process for you in a way.

- Client Checkout: Your client selects images and proceeds to checkout.

- Payment Processing: ShootProof securely processes the credit card transaction.

- Funds Transfer: The funds are transferred to your account, minus the processing fees.

The best part is that ShootProof is upfront about its fees. You can check the amount you'll get post transaction which helps you manage your budget more effectively. Keep in mind that a dependable system not streamlines your process but also brings reassurance to your clients.

Also Read This: Uploading a case study on Behance

Breaking Down the Costs Involved

Understanding the details of credit card processing fees on ShootProof can be really advantageous. Its similar to deciphering the nuances in a contract; once you get it you can make well informed choices. Allow me to share some perspectives drawn from my personal experiences and investigations.

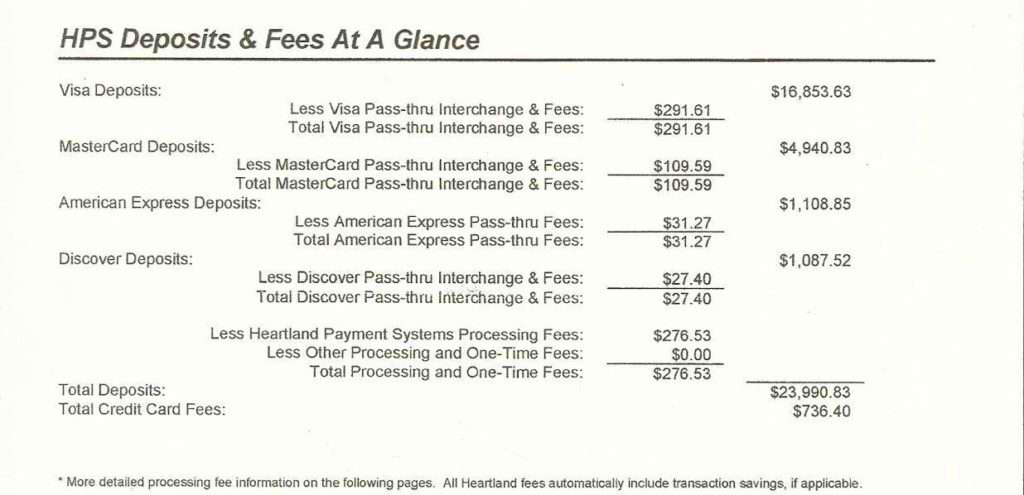

Heres a breakdown of the usual expenses you might encounter.

| Cost Type | Description |

|---|---|

| Transaction Fee | A percentage of the sale, typically ranging from 2.9% to 3.5%. |

| Flat Fee | A small fixed fee per transaction, often around $0.30. |

| Service Fees | Additional fees charged by ShootProof for using their platform, usually monthly or annually. |

The charges can differ depending on various aspects like the kind of card (credit or debit) and whether the transaction takes place offline or online. Its crucial to consider these expenses when determining your pricing approach. I discovered this lesson through experience as I miscalculated my costs initially which resulted in lower profits than expected.

In the end even though credit card processing fees can appear overwhelming grasping their intricacies enables you to enhance your financial choices for your photography venture. By monitoring your transactions staying updated on fee adjustments youll maneuver through this terrain, with assurance.

Also Read This: How to Wear Hijab with Different Styles and Techniques

Factors Influencing Credit Card Processing Fees

As a photographer it's crucial to understand the elements that affect credit card processing fees. I remember my early days in photography when I was completely oblivious to these intricacies. It wasn't until I began examining my income that I discovered how these fees could impact my earnings. Being aware of the factors behind these expenses can greatly assist you in handling your finances.

There are several factors that play a role in the differing credit card processing fees. Here are some important ones to keep in mind.

- Type of Card: Credit cards from different providers come with different fees. Premium cards often have higher processing fees compared to standard cards.

- Transaction Volume: If you process a high volume of transactions, you might be able to negotiate lower fees with your payment processor.

- Payment Method: Online payments typically incur higher fees than in-person transactions due to the increased risk of fraud.

- Business Type: Certain industries face higher risks, which can lead to higher fees. As photographers, we usually fall into a moderate-risk category.

Understanding these aspects not only assists you in selecting a payment processor but also allows you to adjust your pricing accordingly. Keep in mind that every single detail matters in the successful operation of a photography venture.

Also Read This: How Much Do Shutterstock Images Cost

Why Credit Card Processing Fees Matter for Photographers

While credit card processing fees may appear to be an added cost for photographers they can have a profound impact. I still recall my initial major project. I was overjoyed to secure a client but once the fees were taken out my income turned out to be much lower than I expected. This incident made me realize that these fees are not mere figures; they can greatly affect our way of living.

Here’s why it’s important for photographers to grasp these fees.

- Profit Margins: Every fee deducted from your earnings can reduce your profit margin. Knowing this helps you set competitive prices that still cover your costs.

- Cash Flow Management: Understanding when fees will be deducted allows you to plan your cash flow better. It helps you avoid unpleasant surprises.

- Client Expectations: Being transparent about processing fees can enhance your relationship with clients. They appreciate knowing what to expect in their invoices.

Being aware of the costs associated with processing credit card payments gives you an advantage as a photographer. It lets you concentrate on what you love doing while also making sure your business remains viable.

Also Read This: How to Do Art and Craft at Home on Dailymotion Easy and Creative Projects

Comparing ShootProof's Fees with Other Platforms

When selecting a platform for your photography venture it’s crucial to weigh the costs. After trying out different tools I realized that grasping how ShootProofs pricing compares to other options can assist you in making a well informed choice. It goes beyond mere charges; it pertains to the worth you gain in exchange.

Lets take a look at how ShootProofs fees stack up against those of other well known platforms.

| Platform | Transaction Fee | Flat Fee | Additional Fees |

|---|---|---|---|

| ShootProof | 2.9% + $0.30 | None | Monthly subscription for premium features |

| Pixieset | 2.9% + $0.30 | None | Free plan available with limited features |

| Zenfolio | 2.9% + $0.30 | None | Annual fee for premium features |

Youll notice that several platforms charge processing fees. But the real difference comes down to the extra features they offer. ShootProof provides a smooth experience designed specifically for photographers while some other platforms might have hidden charges or restrictions in their free plans. I often believe that choosing the platform can improve my efficiency and ShootProof has definitely achieved that for me.

In the end, it’s all about striking a balance between pricing and functionalities. Take a moment to assess the offerings of each platform and select one that suits your business requirements. Your dedication deserves nothing but the finest resources at hand!

Also Read This: How to Download Bulk Instagram Images?

Tips for Managing Processing Fees Effectively

Dealing with credit card processing fees can be a challenge for photographers like us who put our passion into our craft. I recall my early days in this industry when the fees appeared as a hidden threat in my financial statements. Nevertheless I discovered a few strategies to help me keep those costs in check. Here are some helpful suggestions to effectively manage those processing fees.

- Shop Around for Processors: Just like you wouldn’t settle for the first camera you find, don’t settle for the first payment processor. Compare fees, services, and features before making a choice.

- Negotiate Fees: If you have a solid transaction history, don’t hesitate to negotiate lower fees with your payment processor. They often value long-term relationships.

- Set Minimum Purchase Amounts: For smaller projects, consider setting a minimum purchase amount to offset the fixed fees. This way, you ensure that the costs don’t eat into your profits.

- Use In-Person Payments: If possible, encourage clients to pay in person, as these transactions usually incur lower fees than online payments.

- Keep Records: Track all your transactions and the associated fees. This data helps you understand your expenses better and can be a powerful negotiation tool.

By putting these tactics into action you can really improve your money situation. When you take control of those costs you can shift your attention towards enjoying precious moments instead of stressing over your finances.

Also Read This: Reviewer Compensation on Shutterstock

Frequently Asked Questions About ShootProof Processing Fees

As a photographer dealing with processing fees can bring up a lot of inquiries. Personally I’ve discovered that gaining insight into them eases worries. To assist you in clearing up any uncertainties I’ve put together a list of questions regarding ShootProofs processing fees that may prove helpful.

- What is the typical transaction fee for ShootProof?

The standard fee is usually around 2.9% plus $0.30 per transaction, which is comparable to many other platforms. - Are there any hidden fees?

ShootProof prides itself on transparency, so there are no hidden fees, but you should be aware of potential subscription fees for premium features. - Can I negotiate my fees?

Yes! If you have a consistent transaction volume, you may be able to negotiate lower fees. - Do fees vary by card type?

Absolutely. Credit cards from different providers may come with varying fees, especially premium cards. - How can I reduce processing fees?

Consider encouraging in-person payments, setting minimum purchase amounts, or shopping around for a more competitive processor.

These frequently asked questions can assist you in gaining a better understanding of ShootProofs fee system. Its important to stay knowledgeable about the details to ensure the smooth operation of a thriving photography venture.

Wrapping Up Thoughts on Credit Card Processing Fees

In wrapping up our talk about credit card processing fees it's important to acknowledge how they affect your photography venture. When I launched my career I didn't fully grasp the importance of these charges assuming they were merely a minor inconvenience. Nevertheless as I progressed I came to understand that they have an impact on my bottom line and overall achievements.

Here are some concluding reflections to consider.

- Be Proactive: Stay informed about any changes in fees or payment processing methods. Knowledge is power, especially in financial matters.

- Plan for Fees: Factor these fees into your pricing strategy from the outset. This foresight can save you from unpleasant surprises later on.

- Build Client Relationships: Communicate openly with your clients about payment processes. A transparent approach fosters trust and satisfaction.

Ultimately handling credit card processing fees is all about giving you the power and providing transparency. When you grasp and manage these expenses you can direct your attention towards what truly counts – your love for photography. Let every snap of the camera serve as a reminder of the wonderful adventure you're embarking on without being burdened by concerns!